E-Mini Dow - Maintain Ascending Mode

rhboskres

Publish date: Mon, 15 Mar 2021, 08:59 AM

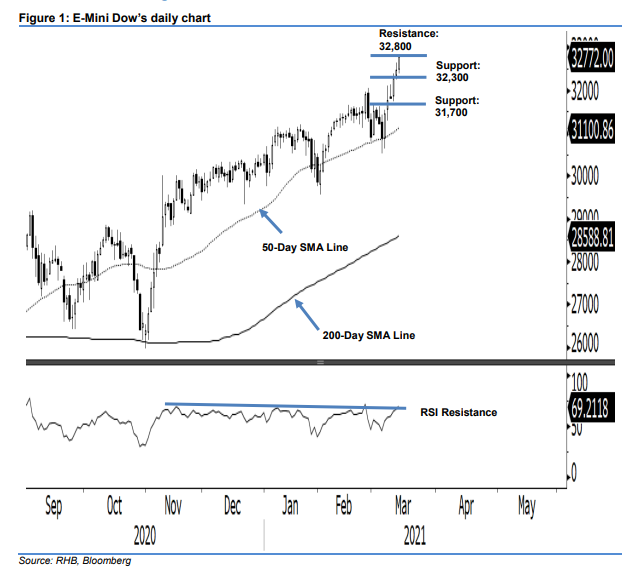

Maintain long positions as the momentum is still positive. The E-Mini Dow shrugged off its earlier session’s weakness – which saw the index dip to a low of 32,389 pts – to close 293 pts higher at 32,772 pts, crossing above the previous immediate resistance of 32,500 pts. The RSI also marginally crossed above the resistance line, suggesting good price momentum. Despite sharp gains over the past 1.5 weeks ie after completing a classic narrow A-B-C corrective pattern on 4 Mar, buyers are still seen to be reluctant to take profit in a meaningful way. From the chart, we do not see any price exhaustion/reversal signals. As such, maintain our positive trading bias.

We recommend traders stay in long positions. We initiated these at 31,509 pts, or the closing level of 1 Mar. For risk management purposes, a stop-loss can be placed at the breakeven mark.

The support levels are revised to 32,300 pts, followed by 31,700 pts. Towards the upside, the immediate resistance is set at 32,800 pts, followed by 33,000 pts.

Source: RHB Securities Research - 15 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024