E-Mini Dow - Bulls in Good Control

rhboskres

Publish date: Tue, 16 Mar 2021, 08:54 AM

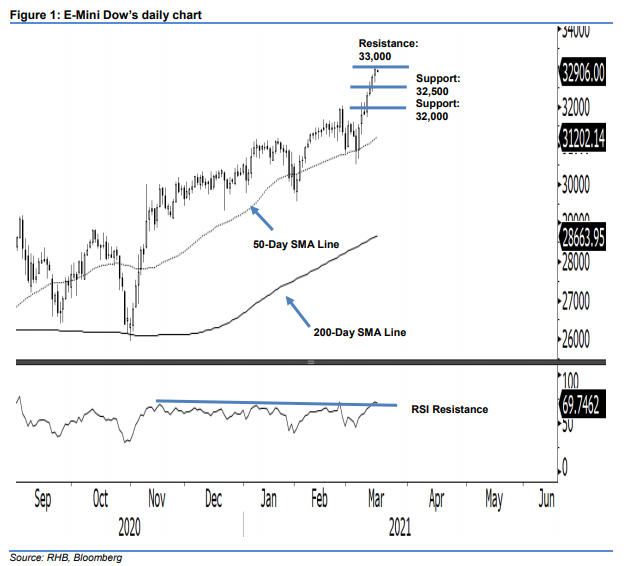

Maintain long positions. The E-Mini Dow experienced a lower timeframe sideways consolidation for the large part of yesterday’s session – a normal process following its recent gains. The minor consolidation phase was completed during the US trading hours, which saw the index recover from an intraday low of 32,624 pts, to end 185 pts higher at 32,957 pts – a record closing. While the RSI has marginally re-entered the overbought zone, we see the breakout from its resistance line (as depicted in the chart) as a more positive overriding factor, as it indicates positive price momentum. In the absence of price reversal signals, we keep our positive trading bias.

We recommend traders stay in long positions. We initiated these at 31,509 pts, or the closing level of 1 Mar. For risk management purposes, a stop-loss can be placed at the breakeven mark.

Support levels are revised to 32,500 pts, followed by 32,000 pts. Meanwhile, the immediate resistance is set at the 33,000-pt round figure, followed by 33,300 pts.

Source: RHB Securities Research - 16 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024