FCPO - Bullish Momentum Continues

rhboskres

Publish date: Tue, 16 Mar 2021, 09:05 AM

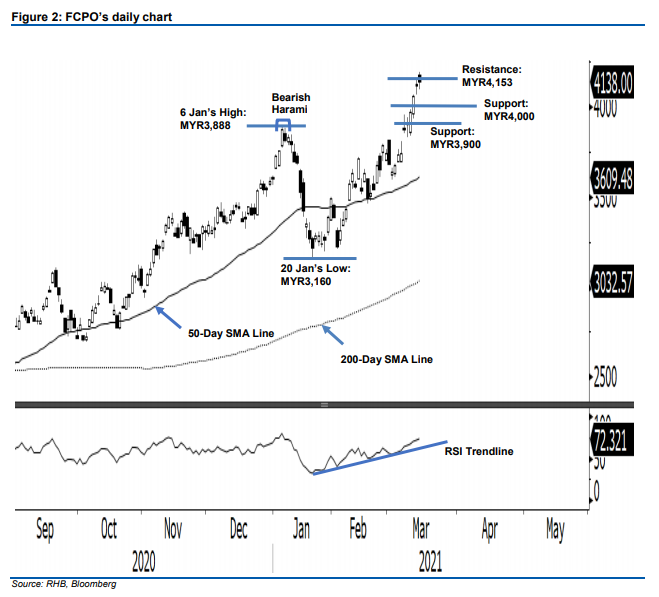

Maintain long positions. Despite profit-taking activities, the FCPO continued to chart a new high for 2021, adding MYR13.00 to close at MYR4,138 yesterday – marking an increase for the ninth straight session. Yesterday, it gapped up by MYR50.00 to start at MYR4,175, but gradually pared down gains to drop to the day’s low of MYR4,098. Just before trading ended, strong buying pressure lifted the price towards the day’s high of MYR4,192. The RSI indicator is trending higher, in tandem with the commodity prices – indicating that the bullish momentum is intact and there are no signs of fatigue yet. The most active futures contract month will move from May 2021 to Jun 2021, from Tuesday onwards. Although the commodity’s price may correct southwards, we expect it to be range-bound between MYR4,000 and MYR3,900. The uptrend should resume after the consolidation. As such, we maintain a positive trading bias.

We recommend that traders stick to long positions, which were initiated at MYR3,878, or the closing level of 8 Mar. As the Jun 2021 futures contract settlement price was MYR4,020 and to protect against downside risks, we revise our trailing-stop to MYR3,974.

The nearest support level remains at MYR4,000, followed by MYR3,900. Towards the upside, the immediate resistance is pegged at 12 Mar’s high of MYR4,153, followed by MYR4,200.

Source: RHB Securities Research - 16 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024