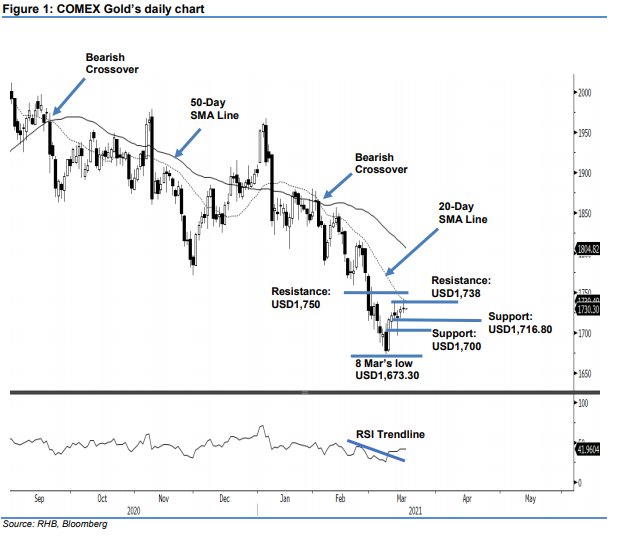

COMEX Gold - Consolidating Near the 20-Day SMA Line

rhboskres

Publish date: Wed, 17 Mar 2021, 05:49 PM

Maintain long positions. The COMEX Gold had a neutral session on Tuesday, adding USD1.70 to settle at USD1,730.90. Ahead of today’s monetary policy announcement by the US FOMC, the commodity saw a narrow trading range yesterday, capped by the session’s high of USD1,733.90 and low of USD1,726. If the interest rate decision is favourable to the precious metal, it may cross the 20-day SMA line in the next session, and the recent counter-trend rebound will extend further towards the 50-day SMA line. Otherwise, expect a correction, and the commodity could retest the USD1,700 psychological level. As long as the stop-loss level stays intact, we will keep our positive trading bias.

We recommend traders shift to the long positions initiated at USD1,729.20 or the closing level of 15 Mar. For risk management purposes, the stop-loss is raised to USD1,710.

Immediate support is marked at 11 Mar’s low of USD1,716.80, followed by the USD1,700 psychological level. Towards the upside, the resistance is pegged at 11 Mar’s USD1,738 high, followed by the USD1,750 round figure.

Source: RHB Securities Research - 17 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024