FCPO - Negative Momentum Emerges

rhboskres

Publish date: Wed, 17 Mar 2021, 06:11 PM

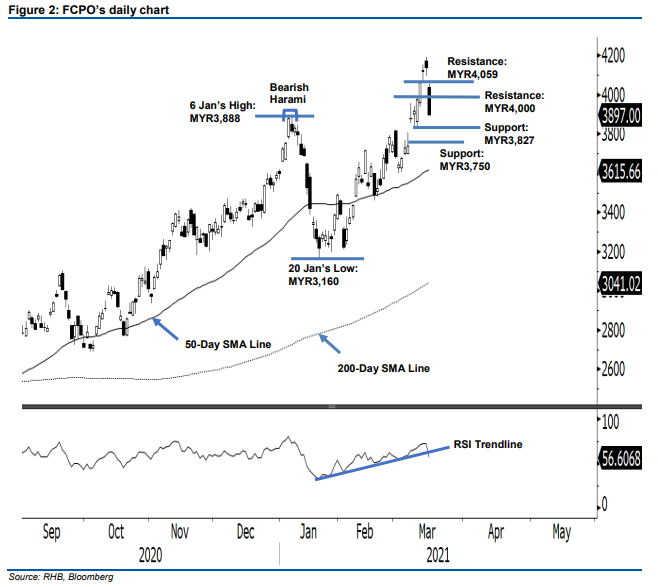

Triggered trailing-stop; initiate short positions. Due to profit-taking activities being extended, the FCPO Jun 2021 futures contract saw a huge sell-off. The commodity plunged by MYR123.00 to close at MYR3,897 – breaching below the psychological level of MYR4,000. Yesterday, it opened at MYR4,040, and climbed to the day’s high of MYR4,059. It moved sideways for most of the trading day, but fell to the day’s low of MYR3,891 in the afternoon. The RSI indicator sank below the uptrend line, suggesting that the correction phase has just started. The commodity will likely see a price pullback to the nearest support level of MYR3,827. Breaching the MYR3,827 level would lead to a “lower low”, where the commodity may undergo a deeper correction towards MYR3,750. Since the negative momentum is building, we shift our trading bias to negative.

We close out the long positions in the latest session, after triggering the trailing-stop of MYR3,974. Conversely, we initiate short positions at the closing level of 16 Mar. To manage risks, we set the stop-loss at MYR4,040.

The nearest support is revised to 9 Mar’s low of MYR3,827, followed by MYR3,750. Towards the upside, the immediate resistance is pegged at the psychological level of MYR4,000, followed by 16 Mar’s high of MYR4,059.

Source: RHB Securities Research - 17 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024