WTI Crude - Re-Testing the USD64.00 Support

rhboskres

Publish date: Thu, 18 Mar 2021, 04:47 PM

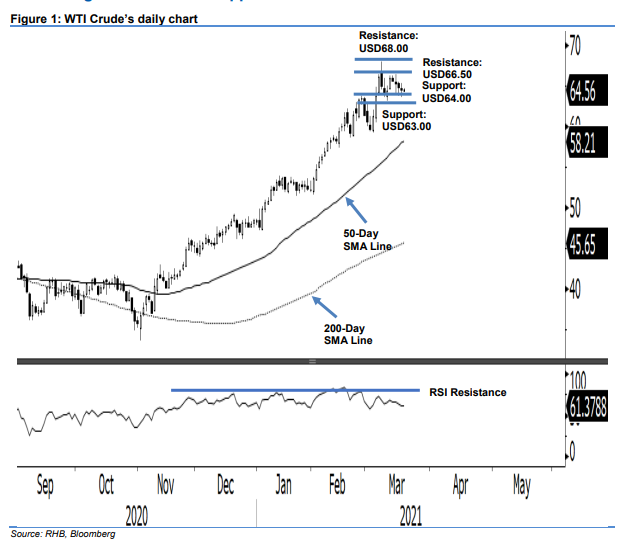

Maintain long positions. The WTI Crude deployed the same intraday price script for the third consecutive session ie reversing to narrow intraday losses after nearing/marginally crossing below the USD64.00 support level. After hitting a low of USD63.60, the commodity rebounded towards the end of the session to settle at USD64.60 – a USD0.20 decline. We view the said immediate support as a level that the bulls are attempting to defend – this is to avoid technical damage, which, if it happens, could open the door for a deeper and lengthier correction phase to set in. For now, we are keeping our positive trading bias.

We recommend traders stay in long positions. We initiated these at USD49.93, or the closing level of 5 Jan. To manage risks, a stop-loss can now be placed below the USD64.00 threshold.

Support levels are maintained at USD64.00 and USD63.00. Conversely, the resistance levels are set at USD66.50 and USD68.00.

Source: RHB Securities Research - 18 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024