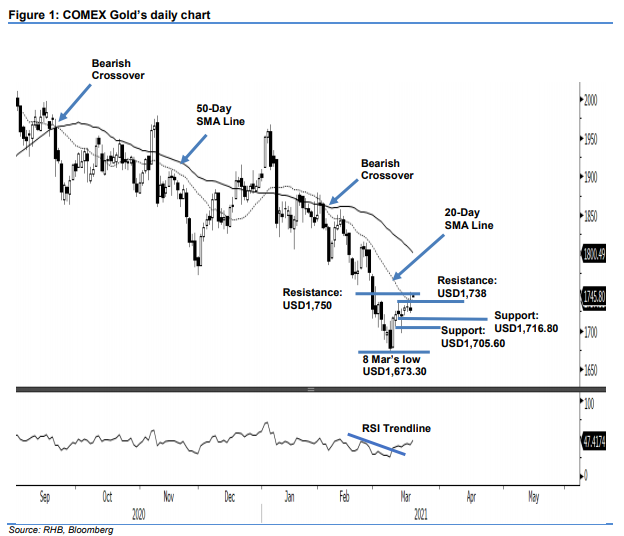

COMEX Gold - Testing the 20-Day SMA Line

rhboskres

Publish date: Thu, 18 Mar 2021, 04:49 PM

Maintain long positions. The COMEX Gold had a volatile session on Wednesday, ending USD3.80 lower at USD1,727.10. The commodity opened at USD1,730 and fell to the session low’s of USD1,722. After the US FOMC announced to keep key interest rates unchanged, the COMEX Gold found footing at the session’s low and surged to the session’s high of USD1,750.60. Just before market closed for settlement, it last traded at USD1,744. Since witnessing the bullish momentum during intraday price action, we expect the commodity to retest the nearest resistance at USD1,738 – a level near to the 20-day SMA line. As mentioned previously, the crossing of the 20-day SMA line will see the commodity extend higher to test the 50-day SMA line. Since the RSI has broken away from the downtrend line, indicating acceleration of positive momentum, we maintain our positive trading bias.

We recommend traders stick to long positions initiated at USD1,729.20 or the closing level of 15 Mar. For risk management purposes, the stop-loss is revised to USD1,715.

The immediate support remains at 11 Mar’s low of USD1,716.80, followed by 10 Mar’s low of USD1,705.60. Towards the upside, the resistance is eyed at 11 Mar’s USD1,738 high, followed by USD1,750.

Source: RHB Securities Research - 18 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024