WTI Crude - Entering the Multi-Month Consolidation Phase

rhboskres

Publish date: Fri, 19 Mar 2021, 05:24 PM

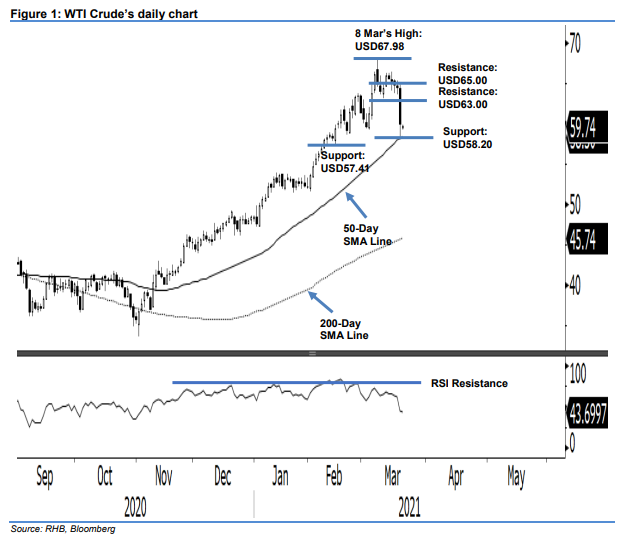

Initiate short positions. The WTI Crude experienced a washout session which saw prices drop USD4.60 to close at USD60.00 – testing the 50-day SMA line in the process. The commodity’s failure to stay above the previous support level of USD64.00, suggests that its multi-month uptrend had reached an interim top at USD67.80 on 8 Mar, and chances are high for a lengthy consolidation phase to develop in the coming months. At this juncture, it is still too early to predict the form of the correction pattern that could take place. In the coming sessions, a minor counter-trend rebound may develop around the abovementioned SMA line, but the next big move is still tilted towards the downside. We switch our trading bias from positive to negative.

Our previous long positions, initiated at USD49.93 or the closing level of 5 Jan, were closed out in the latest session. Concurrently, we initiate short positions. To manage risks, a stop-loss can be placed above USD65.00.

Support levels are revised to USD58.20 – latest low – followed by USD57.41, which was derived from 12 Feb’s low. On the upside, the immediate resistance is marked at USD63.00, followed by USD65.00.

Source: RHB Securities Research - 19 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024