Hang Seng Index Futures - A Wall Too Thick

rhboskres

Publish date: Fri, 19 Mar 2021, 05:26 PM

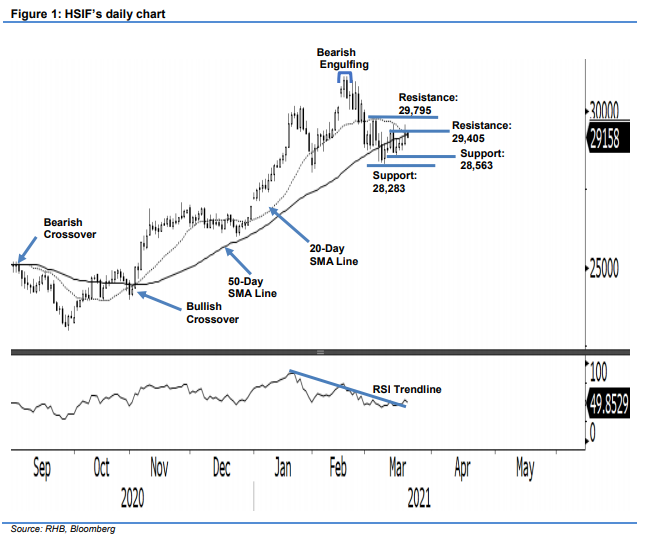

Maintain short positions. While the HSIF saw positive price action yesterday, it did not manage to cross the 29,405- pt resistance level. It started the day’s session at 29,279 pts, surging to a high of 29,575 pts. However, the bulls hesitated, and the index pared its gains to end the session at 29,369 pts – a 378-pt gain from the previous session. Mild consolidation was seen in the evening session, with a pullback before it was last traded at 29,158 pts. As the RSI is capped below the 50% threshold, the HSIF is likely to consolidate sideways before retesting the resistance level. However, the 20-day SMA line crossed below the 50-day SMA line yesterday, indicating that the downtrend has just started. Expect selling pressure to increase in the coming sessions. As such, we keep our negative trading bias.

We recommend traders maintain the short positions initiated at 30,077 pts, or the closing level of 22 Feb. For risk management purposes, the trailing-stop is kept at 29,405 pts.

The support level is marked at 15 Mar’s low of 28,563 pts, followed by 9 March’s low of 28,283 pts. Towards the upside, the immediate resistance is pegged at 11 Mar’s high of 29,405 pts, followed by 3 Mar’s high of 29,795 pts.

Source: RHB Securities Research - 19 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024