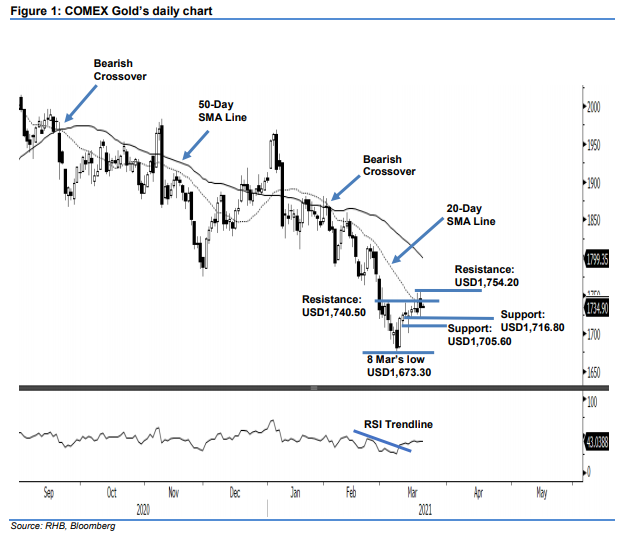

COMEX Gold - Blocked by the 20-Day SMA Line

rhboskres

Publish date: Fri, 19 Mar 2021, 05:27 PM

Maintain long positions. Despite rejection from the 20-day SMA line, the COMEX Gold gained USD5.40 to settle at USD1,732.50. It had a strong start on Thursday, gapping up USD16.90 to open at USD1,744. It climbed to the session’s USD1,754.20 high before paring its gains, and dipping to the low of USD1,716.60. It was last traded at USD1,732.50. The counter-trend rebound is facing strong resistance from the 20-day SMA line. With the RSI indicator pointing upwards, there is still possibility of the commodity retesting the USD1,740.50 level, and the counter-trend rebound extending towards USD1,754.20. Meanwhile, strong buying interest was seen near USD1,716.80, where a long lower shadow pattern has formed. However, a breach of the USD1,715 stop-loss level may see the resumption of downward movement. As it remains intact, we maintain our positive trading bias.

We recommend traders maintain long positions, initiated at USD1,729.20 or the closing level of 15 Mar. For risk management purposes, the stop-loss is revised to USD1,715.

The immediate support is unchanged at 11 Mar’s low of USD1,716.80, followed by USD1,705.60. Towards the upside, the resistance is pegged at 16 Mar’s high of USD1,740.50, followed by 18 Mar’s high of USD1,754.20.

Source: RHB Securities Research - 19 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024