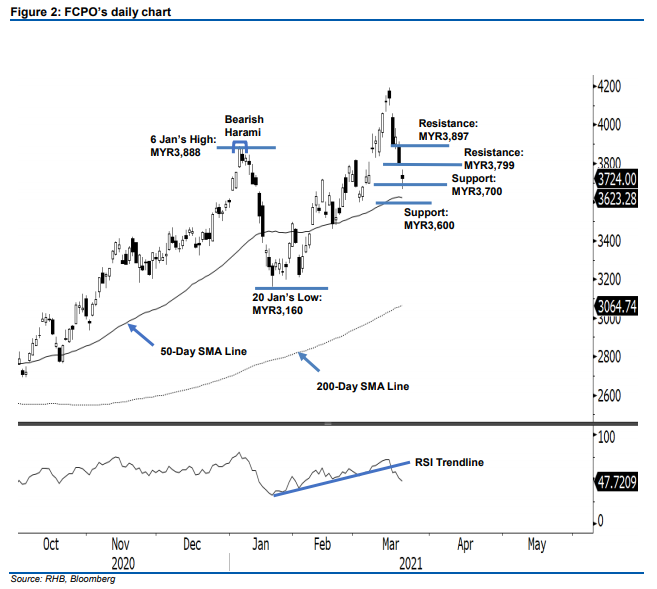

FCPO - Testing The MYR3,700 Level

rhboskres

Publish date: Mon, 22 Mar 2021, 08:47 AM

Maintain short positions. FCPO continued to undergo selling pressure last Friday, and closed MYR72.00 lower, at MYR3,724. It gapped down by MYR56.00 to start the session at MYR3,740, and was dragged by negative momentum towards the day’s low of MYR3,667. In the afternoon, it bounced to MYR3,724 to close the session. The soft commodity ended the session by forming a long lower shadow pattern, indicating strong demand near the MYR3,700 level. With the RSI indicator moving below the threshold of 50%, thereby showing a weak momentum, the commodity may need to consolidate before it can rebound to test the immediate resistance level of MYR3,799. If the MYR3,700 level gives way, the commodity will likely move downwards to test the 50-day SMA line, or MYR3,600 level. Since the bears are still in control, we are maintaining a negative trading bias.

We recommend that traders stay in short positions, which were initiated at MYR3,897 or the closing level of 16 Mar. To manage risks, the stop-loss is revised to MYR3,850.

The nearest support is marked at the round number of MYR3,700, followed by MYR3,600. Towards the upside, the immediate resistance level is pegged to 18 Mar’s close of MYR3,799 level, followed by 16 Mar’s close of MYR3,897.

Source: RHB Securities Research - 22 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024