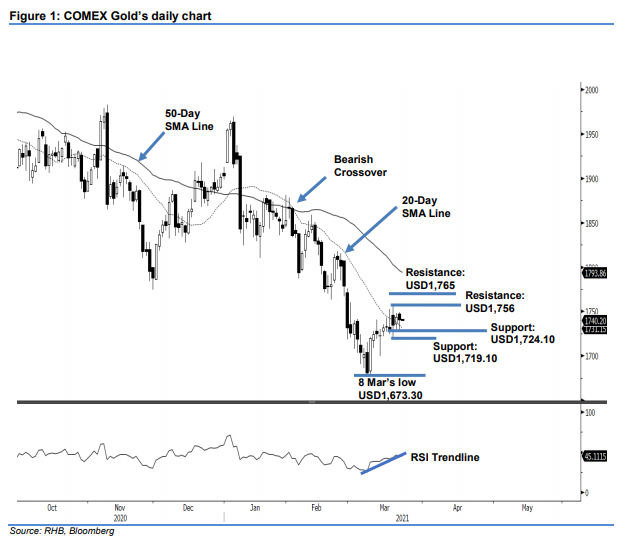

COMEX Gold - Consolidates Near the 20-Day SMA Line

rhboskres

Publish date: Tue, 23 Mar 2021, 08:58 AM

Maintain long positions. Despite a mild buying pressure yesterday, the COMEX Gold dipped USD3.50 to settle lower at USD1,740.40, and still managed to close above the 20-day SMA line. The commodity started the session at USD1,747.50 and saw selling pressure that dragged it towards the USD1,728.60 session low. During the European trading hours, it found its footing near the 20-day SMA line and rebounded to close at USD1,740.40. Although the recent counter-trend rebound has lifted prices higher, the 20-day SMA line still points downwards. If the COMEX Gold fails to move higher and breaches the USD1,715 level, it may see a deeper correction and revert to a downtrend mode. Yet, as long as the stop-loss level stays intact, we stick to our positive trading bias.

We recommend traders maintain long positions initiated at USD1,729.20, or the closing level of 15 Mar. For riskmanagement purposes, the stop loss is set at USD1,715.

The immediate support is revised to 17 Mar’s low of USD1,724.10 and followed by 18 Mar’s low of USD1,719.10. Towards the upside, the immediate resistance is revised to 18 Mar’s high of USD1,756 and followed by the USD1,765 whole number.

Source: RHB Securities Research - 23 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024