FCPO - Breaching The MYR3,900 Level

rhboskres

Publish date: Wed, 24 Mar 2021, 06:14 PM

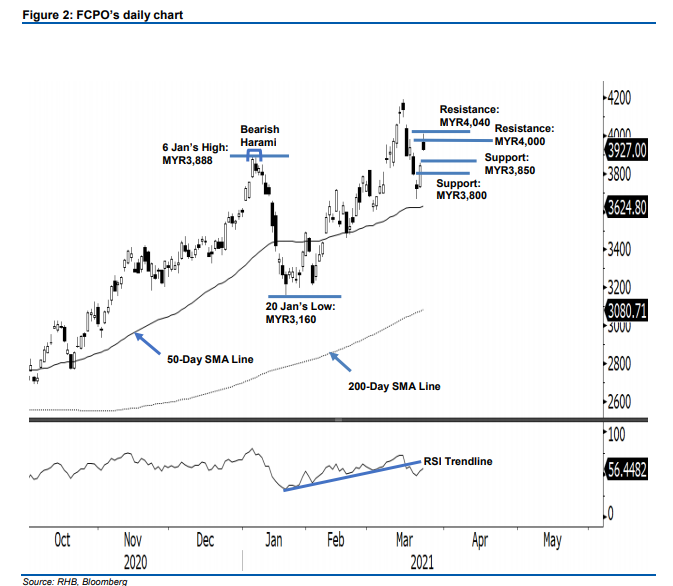

Stop loss triggered; initiate long positions. The FCPO surged MYR87.00 to settle at MYR3,930 – reclaiming the MYR3,900 territory. The commodity started the session with a strong opening, gapping MYR122.00 to start at MYR3,965. During the early session, the bullish momentum lifted prices towards the session high of MYR4,011 – breaching the MYR4,000 physcological level. The bulls failed to hold on to the gains, however, and profit-taking activities dragged the FCPO to a session low of MYR3,921 – it closed at MYR3,930. If such activities extend, the commodity may drift lower and find support near the MYR3,850-pt level. Consolidation may occur near this support level. As the momentum indicator RSI has been observed pointing upward, the bulls may retest the MYR4,000 level again in the near future after consolidating. Since the stop loss was triggered, we shift to a positive trading bias.

After triggering a stop loss at MYR3,850, we closed out the previous short positions initiated at MYR3,897, or the closing level of 16 Mar. Conversely, we initiate long positions at the closing level of 23 Mar. To manage risks, the stoploss level is set at MYR3,835.

The downside support is marked at the MYR3,850 round number and followed by MYR3,800. Towards the upside, the immediate resistance level is pegged at the MYR4,000 pyscological level and followed by the MYR4,040 round number.

Source: RHB Securities Research - 24 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024