WTI Crude - Back to USD60.00 Again

rhboskres

Publish date: Thu, 25 Mar 2021, 04:24 PM

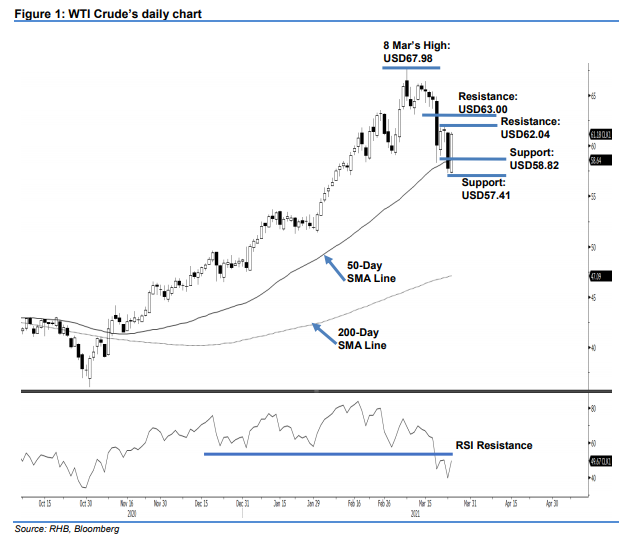

Maintain short positions. The WTI Crude saw a strong rebound yesterday, surging USD3.42 to settle at USD61.18. The commodity initially gapped down lower to start the session at USD57.40 and went to a session low of USD57.29. During Asia’s trading afternoon, we started seeing strong buying interest, which lifted the WTI Crude towards the session high of USD61.34. It settled at USD61.18, forming a bullish reversal pattern near the 50-day SMA line. Although the demand was strong, its latest prices did not engulf the previous bearish candle. Hence, the WTI Crude is still exhibiting a lower high pattern, with resistances pegged at USD62.04 and USD63.00. Underpinned by yesterday’s strong momentum, it will likely consolidate near the 50-day SMA line. We maintain our negative trading bias until the stop loss is breached.

We recommend traders to maintain short positions – this was initiated at USD60.06, or the closing level of 18 Mar. To manage risks, the stop loss is set at USD61.50.

The nearest support level is revised to 22 Feb’s low of USD58.82, followed by 12 Feb’s USD57.41 low. On the upside, the immediate resistance is pegged at 22 Mar’s high of USD62.04 and followed by the USD63.00 whole number.

Source: RHB Securities Research - 25 Mar 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024