COMEX Gold - Counter-Trend Rebound Is Intact

rhboskres

Publish date: Thu, 08 Apr 2021, 04:38 PM

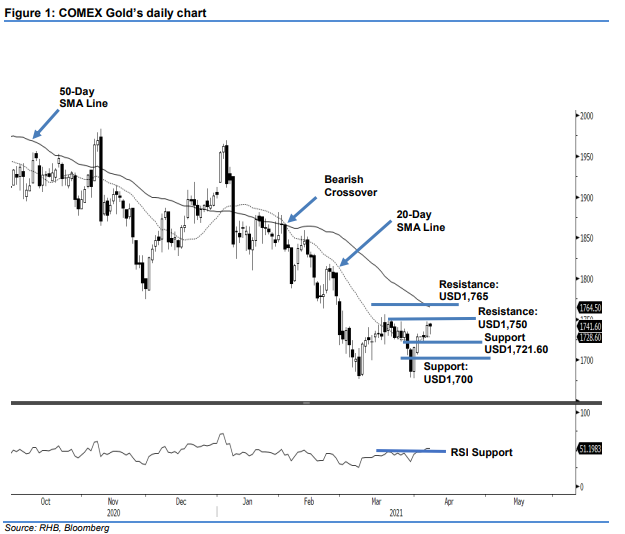

Maintain long positions. Despite selling pressure during the early session, the COMEX Gold manage to pare most of the losses and record a minor decline of USD1.40 to settle at USD1,741.60. Yesterday, the precious metal started at USD1,744.40 and fell to a session low of USD1,731.20. It then rebounded during the US trading hours towards the USD1,745.40 session high and close at USD1,741.60. A typical “higher low” upward movement was still sighted and, coupled with prices staying above the 20-day SMA line, the counter-trend rebound remains intact. As the RSI moving above 50% threshold, this increases the probability that the bullish momentum may continue to travel towards the 50-day SMA line. If this happens, we may see a Bullish Crossover of both moving averages in the coming sessions. As the selling pressure is contained, we keep to our positive trading bias.

We recommend traders keep the long positions initiated at USD1,715.60 on 31 Mar. For risk-management purposes, the stop loss is set at USD1,700.

The immediate support is marked at 5 Apr’s low of USD1,721.60 and followed by USD1,700. Towards the upside, the nearest resistance is pegged at the USD1,750 round figure and followed by USD1,765.

Source: RHB Securities Research - 8 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024