WTI Crude - Clinging on the 50-Day SMA Line

rhboskres

Publish date: Thu, 08 Apr 2021, 04:44 PM

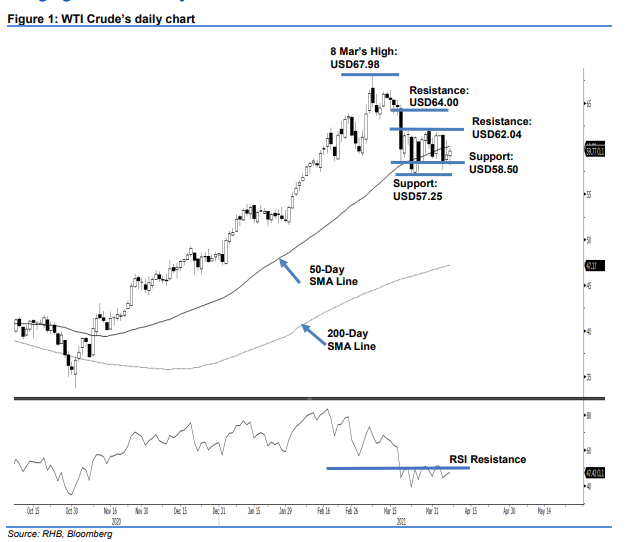

Maintain long positions. The WTI Crude saw selling pressure fizzle out during the US trading hours, inching USD0.44 to settle at USD59.77. It started Wednesday’s session at USD59.26 but, after touching the USD60.04 session high, it fell to the session low of USD58.12. Bargain hunting during late hours pared the earlier losses and lifted it to close in positive territory of USD59.77. Although the WTI Crude failed to establish a foothold above the USD60.00 psychological level, as long as it stays above USD58.50, the commodity may resume its bullish momentum and retest the 50-day SMA line in coming sessions. Breaching USD58.50 may see the “lower low” pattern forming and increase risk of of downward movements. Until then, we stick to our positive trading bias.

We recommend traders stay in long positions. These were initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop loss is placed at USD58.50.

The nearest support level remains at USD58.50 and followed by 23 Mar’s low of USD57.25. On the upside, the immediate resistance is seen at 22 Mar’s USD62.04 high and followed by USD64.00.

Source: RHB Securities Research - 8 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024