WTI Crude - Still Consolidating Sideways

rhboskres

Publish date: Mon, 12 Apr 2021, 09:31 AM

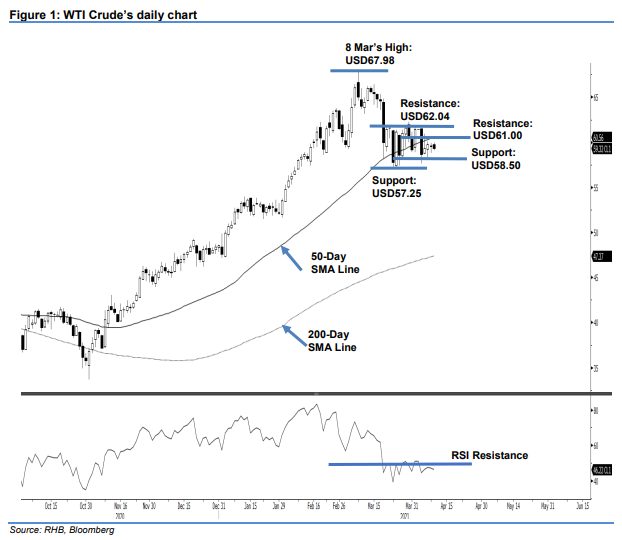

Maintain long positions. The WTI Crude continues moving sideways while consolidating near the USD59.00 mark. It started last Friday’s session at USD59.76. After trading within the narrow range of the USD59.95 session high and session low of USD59.10, the commodity closed at USD59.32 with a minor loss of USD0.28 vis-à-vis last Thursday’s session. Both bulls and bears are still adopting a wait-and-see approach while moving horizontally within the USD61.00-58.50 band. The WTI Crude will continue moving sideways until it breaks out from either side of this band. Since the stop-loss level remains intact, we maintain our positive trading bias.

We recommend traders stick to long positions, which were initiated at USD61.56, or the closing level of 29 Mar. To manage risks, the stop-loss level is placed at USD58.50.

The nearest support level remains at USD58.50, followed by 23 Mar’s low of USD57.25. On the upside, the immediate resistance remains at the USD61.00 whole number and followed by 22 Mar’s USD62.04 high.

Source: RHB Securities Research - 12 Apr 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024