FCPO - Consolidating Near The 200-Day SMA Line

rhboskres

Publish date: Tue, 22 Jun 2021, 10:59 AM

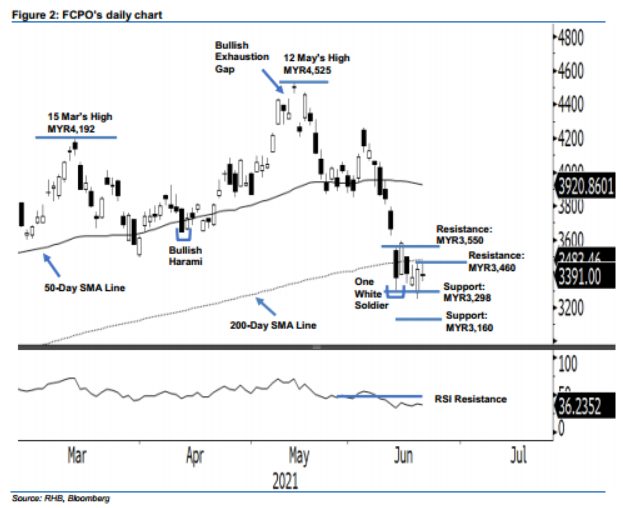

Maintain short positions. Yesterday, the FCPO moved sideways after it failed to test the 200-day SMA line for the third session in a row. It closed MYR33.00 lower at MYR3,391 yesterday. The commodity initially opened (neutral) at MYR3,394 and whipsawed horizontally between the intra-day high and low of MYR3,455 and MYR3,350, before closing. Based on recent price actions, it is attempting to form an interim base near the MYR3,298 support level. If this is successful, it may stage a technical rebound, to breach the MYR3,550 resistance level, or at least reclaim the 200- day SMA line territory (MYR3,483). On the other hand, if the immediate support level gives way, the FCPO may extend the correction towards the low of 2021, which is MYR3,160. At this juncture, we will maintain a negative trading bias until the traling stop is breached.

Traders should stay in short positions. We initiated these at the closing level of 8 Jun, or MYR4,049. To manage risks and protect profits, the trailing-stop mark is adjusted to MYR3,500.

The support levels are pegged at MYR3,298 – the low of 14 Jun – and then MYR3,160, or the 20 Jan’s low. Towards the upside, the resistance levels revised to MYR3,460 the high of 18 Jun and followed by MYR3,550 ie 14 Jun’s high.

Source: RHB Securities Research - 22 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024