COMEX Gold - Momentum Still Weak

rhboskres

Publish date: Wed, 23 Jun 2021, 05:58 PM

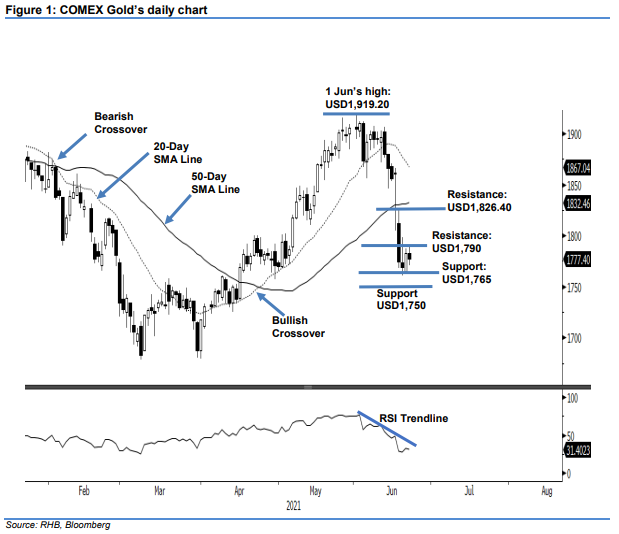

Maintain short positions. The COMEX Gold dipped USD5.50 to settle at USD1,777.40 after the bullish momentum failed to follow though yesterday. The commodity started Tuesday’s session stronger at USD1,783.20. After touching the intraday high of USD1,790.10, it retraced to the USD1,771.20 day low and closed at USD1,777.40. Although the momentum was weak, it did not breach the previous session’s low. Hence, a “higher low” candlestick suggests the possibility of seeing a technical rebound. This needs a confirmation if the yellow metal climbs above USD1,790 in the comng sessions. Since the bulls remain weak, the COMEX Gold may revert to the downward movement again if the nearest USD1,765 support level gives way. We will stick to a negative trading bias until the trailing-stop level is breached.

Traders are advised to maintain short positions initiated at USD1,873.30, or the closing level of 3 Jun. For riskmanagement purposes, the trailing-stop level is set at USD1,790.

The immediate support is fixed at USD1,765 and followed by the USD1,750 round number. On the upside, the nearest resistance is revised to the USD1,790 whole number, followed by the USD1,826.40, ie 17 Jun’s high.

Source: RHB Securities Research - 23 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024