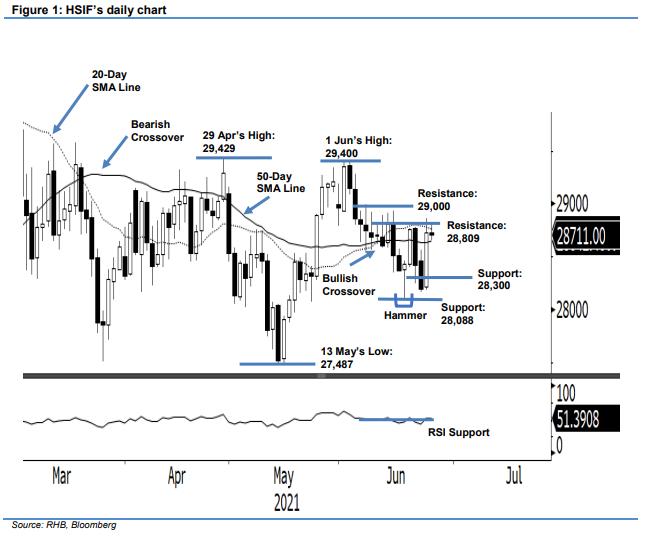

Hang Seng Index Futures - Climbing Above the 50-Day SMA Line Again

rhboskres

Publish date: Thu, 24 Jun 2021, 09:32 AM

Maintain short positions. After establishing a foothold near the 28,300-pt support level, the HSIF jumped above the 50-day SMA line, rising 537 pts to settle the day session at 28,730 pts, ie its best session since 25 May. The index initially started Wednesday’s session at 28,378 pts. After touching the 28,327-pt day low, it reversed towards the 28,857-pt day high and closed at 28,730 pts – forming a white body candlestick. In the evening, it dipped 19 pts to close at 28,711 pts. The HSIF is currently testing the overhead resistance at the 20-day SMA line. Since the RSI has crossed above the 50% threshold, the bullish momentum may lift it higher to cross the 20-day SMA line and pierce through the 28,809-pt resistance level. If this happens, sentiment may change to become risk-on again. As the index is trading below the stop loss, we maintain our negative trading bias.

Traders are advised to keep short positions initiated at the closing level of 15 Jun’s day session, ie 28,509 pts. For risk-management purposes, the stop-loss level is set at 28,890 pts.

The immediate support is placed at 28,300 pts and followed by the low of the Hammer, or 28,088 pts. Conversely, the immediate resistance remains at 28,809 pts – 9 Jun’s high – and followed by 29,000 pts.

Source: RHB Securities Research - 24 Jun 2021