Hang Seng Index Futures - Climbing Back to the 20-Day SMA Line

rhboskres

Publish date: Fri, 25 Jun 2021, 05:29 PM

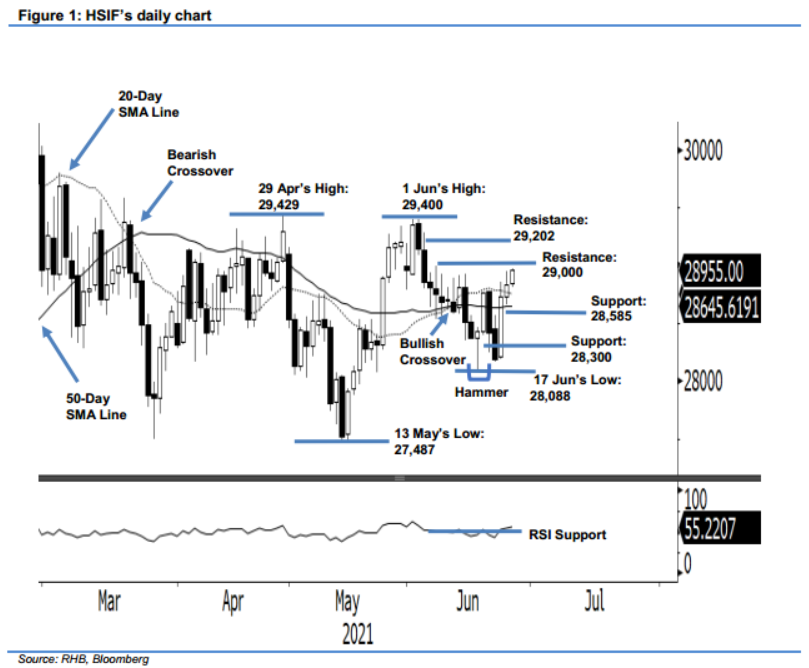

Stop-loss triggered; Initiate long positions. The HSIF saw bullish momentum follow through yesterday, crossing above the 20-day SMA line to settle the day session at 28,829 pts. The index opened stronger yesterday, at 28,705 pts, jumping to a 28,945-pt high early in the session. It retraced mildly to close at 28,829 pts. During the evening session, bullish momentum extended, with the index closing at 28,904 pts – breaching our stop-loss. At the time of writing, the HSIF has climbed to touch 28,955 pts. Underpinned by the strong momentum, the index is poised to end the week with a positive close, recouping the losses incurred over the past three weeks. If it manages to close above the 29,000-pt psychological level, it may rally the index higher and see momentum accelerate. As the index has breached the stop-loss to form a “higher high” pattern, we are shifting to a positive trading bias.

We closed out the short positions initiated at 28,509 pts or the closing level of 15 Jun’s day session after the stop-loss at 28,890 pts was triggered. Conversely, we initiate long positions at the closing level of 25 Jun’s evening session, ie 28,904 pts. For risk management, the initial stop-loss level is set at 28,300 pts.

The immediate support is revised to 28,585 pts, the low of 11 Jun, followed by 28,300 pts. On the upside, the immediate resistance is set 29,000 pts – the psychological level – followed by 29,202 pts, or the high of 27 May.

Source: RHB Securities Research - 25 Jun 2021