E-Mini Dow - Shifting Back to Bullish Momentum

rhboskres

Publish date: Fri, 25 Jun 2021, 05:30 PM

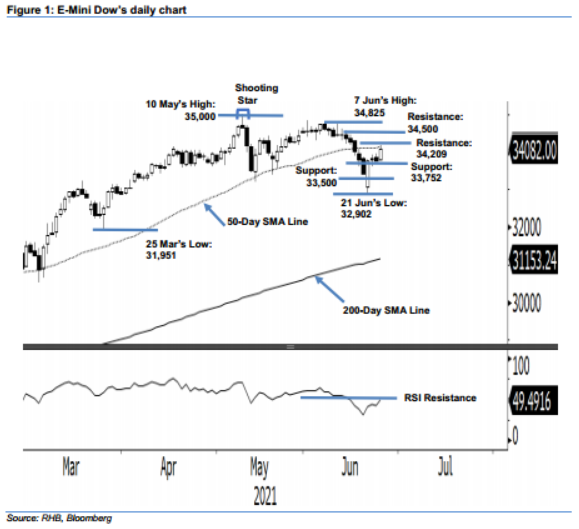

Trailing-stop triggered; Initiate long positions. The E-Mini Dow saw bullish momentum accelerate yesterday, advancing 323 pts to settle at 34,082 pts. It opened at 33,792 pts on Thursday. After barely touching the 33,773-pt intraday low early in the session, it rose to the 34,177-pt session high before closing at 34,082 pts – forming a White Marubozu candlestick pattern. The white body candlestick indicates that the bulls were dominating the session with strong momentum. It is likely the index will see a follow through of momentum to test the 34,209-pt resistance level. If it crosses the resistance, the E-Mini Dow will fall back to the 50-day SMA line with an upward trajectory. As the trailing-stop was breached, we shift to a positive trading bias.

We closed out the short positions initiated at 34,177 pts or the closing level of 15 Jun after the trailing-stop at 33,850 pts was triggered. Conversely, we initiate long positions at the closing level of 24 Jun, ie. 34,082 pts. To manage risks, an initial stop-loss is placed at 33,450 pts.

The immediate support is revised to 33,752 pts, the low of 23 Jun, followed by the 33,500-pt round figure. The immediate resistance is eyed at 34,209 pts, or the high of 16 Jun, followed by the higher hurdle of 34,500 pts.

Source: RHB Securities Research - 25 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024