WTI Crude - Consolidating Near the Resistance

rhboskres

Publish date: Fri, 25 Jun 2021, 05:31 PM

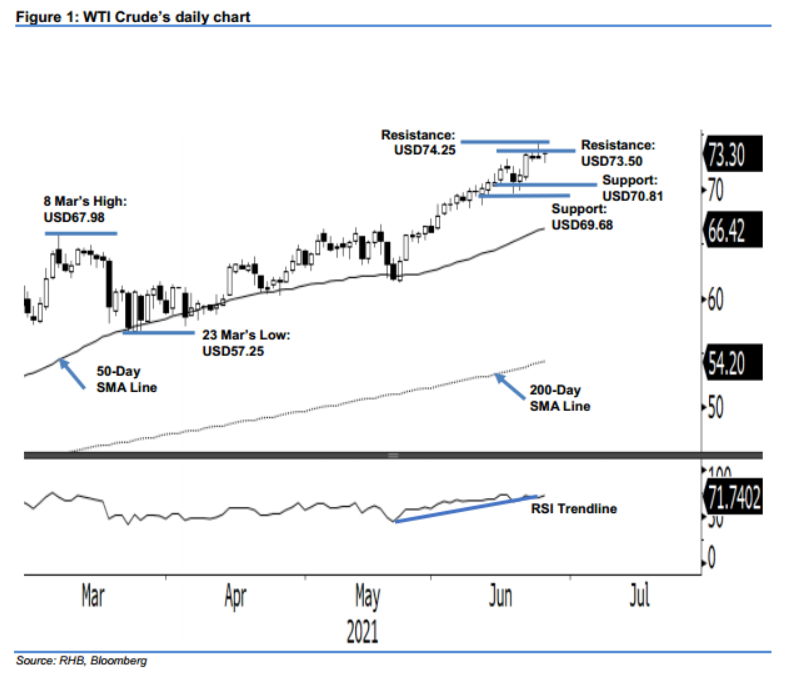

Maintain long positions. The WTI Crude edged higher yesterday to test the resistance pegged at USD73.50, rising USD0.22 to close at USD73.30. On Thursday, the commodity started the session stronger at USD73.28 and rose to the intraday high of USD73.61. Despite mild selling pressure during the European trading hours, the commodity found a footing at the day’s low of USD72.32 and rebounded to close at USD73.30 – higher than the opening price. The white body candlestick formed yesterday showed that the balance of strength leans towards the bulls. As long as it continues to consolidate, momentum may pick up again to retest the upside resistance. Thus far, USD70.81 remains as a strong support level. In light of the positive demand for the commodity, we are keeping our positive trading bias.

Traders should hold on to the long positions initiated at USD66.05, or the closing level of 24 May. To mitigate risks, the trailing-stop is placed at the USD70.78 mark, or 21 Jun’s low.

The immediate support is placed at USD70.81, or the low of 15 Jun, followed by USD69.68 – the low of 11 Jun. Conversely, the immediate resistance is set at USD73.50, followed by USD74.25 – the high of 23 Jun

Source: RHB Securities Research - 25 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024