WTI Crude - Pullback From The Record High

rhboskres

Publish date: Tue, 29 Jun 2021, 08:49 AM

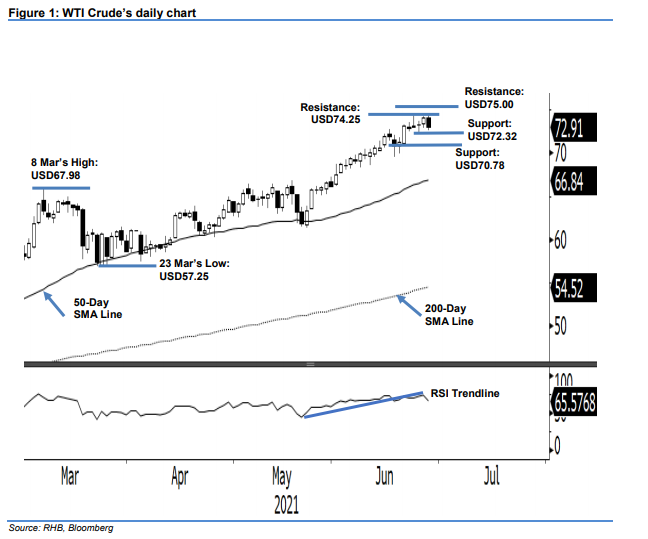

Maintain long positions. The WTI Crude saw mild profit-taking yesterday, pulling back USD1.14 to settle at USD72.91 – slightly below the USD74.00 previous resistance level. It started yesterday’s session on a strong note at USD73.99, and rose to USD74.45. However, the brief momentum did not sustain, and it fell to the session’s low of USD72.62 before settling at USD72.91. The profit-taking activities were within our expectations, and as stated in our previous note, we foresee the USD72.32 level lending strong support. A breach of the support level may see the upward movement taking a longer pause, and a further correction towards USD70.78. However, if bullish momentum picks up again, the bulls will retest the immediate resistance of USD74.25. At this juncture, we keep our positive trading bias.

Traders should keep the long positions initiated at USD66.05, or the closing level of 24 May. To manage risks, the trailing-stop is placed at USD72.00.

The immediate support is marked at USD72.32, or the low of 24 Jun, followed by USD70.78 – the low of 21 Jun. Meanwhile, the immediate resistance is sighted at USD74.25, followed by the USD75.00 psychological level.

Source: RHB Securities Research - 29 Jun 2021