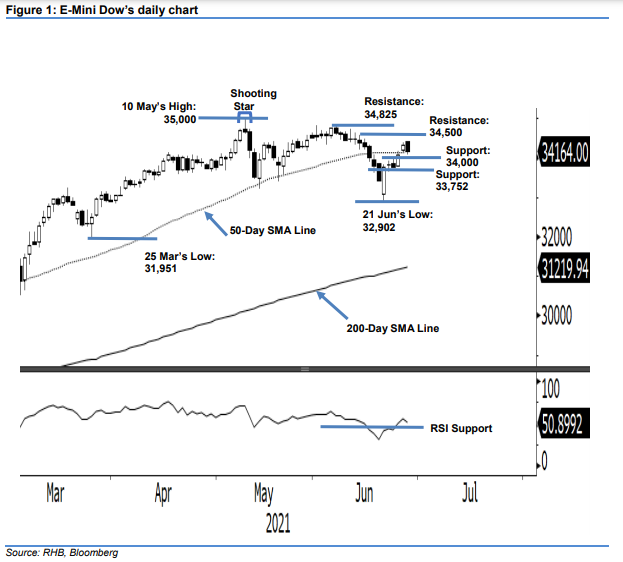

E-Mini Dow - Testing the 50-Day SMA Line Support Level

rhboskres

Publish date: Tue, 29 Jun 2021, 08:49 AM

Maintain long positions. The E-Mini Dow bears were eager to book profits yesterday, with the index shedding 169 pts to settle at 34,164 pts – still well above the 50-day SMA line. On Monday, after opening at 34,398 pts, it bucked the peers to reach an intraday low of 34,067 pts, before closing at 34,164 pts. Although cautious sentiment was seen during yesterday’s session, the index managed to retain the 34,000-pt psychological level, and the current uptrend structure is deemed intact. In the event that profit-taking activities continue, stronger support can be found at the 33,752-pt level. Unless the index breaches the stop-loss, we will stick to our positive trading bias.

We recommend traders hold on to the long positions initiated at 34,082 pts or the closing level of 24 Jun. To manage risks, the stop-loss is fixed at 33,752 pts.

The immediate support is placed at the 34,000-pt psychological level, followed by the low of 23 Jun, or 33,752 pts. On the upside, the immediate resistance remains at 34,500 pts, followed by 7 Jun’s high of 34,825 pts.

Source: RHB Securities Research - 29 Jun 2021