FKLI - Bears Remain In Control

rhboskres

Publish date: Tue, 29 Jun 2021, 08:51 AM

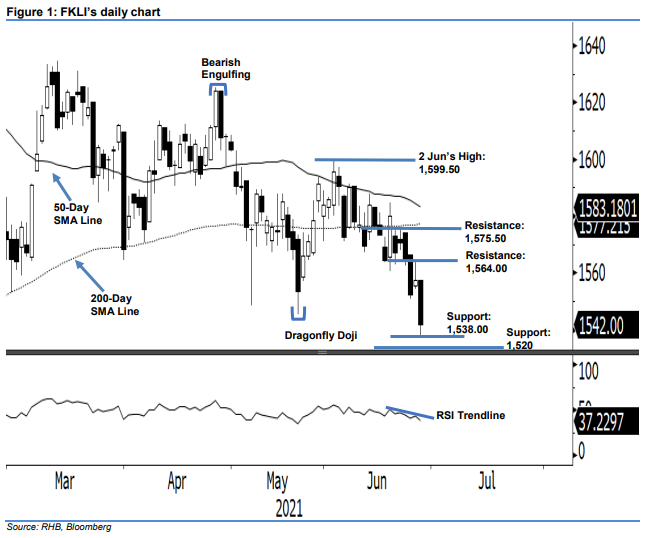

Maintain short positions. On Monday, the FKLI saw selling pressure accelerate as the index tumbled 15.5 pts to close at 1,542.00 pts – its lowest point for 2021. The index initially opened neutral at 1,557.5 pts then immediately fell towards the intraday low of 1,538 pts before it bounced slightly higher to close at 1,542 pts. The bearish price action yesterday signifies that the bears were dominating the session – forming another “lower low” price pattern. Coupled with the RSI trendline curving downwards below the 40% level – the negative momentum may follow through in the coming sessions. Hence, we maintain our negative trading bias.

We suggest that traders stay in short positions. We initiated these at 1,569.50 pts, or the close of 11 Jun. To mitigate risks, the stop-loss is placed at 1,575.50 pts.

The support levels are revised to 1,538.00 pts or 28 Jun’s low, and followed by 1,520 pts. Towards the upside, the immediate resistance level is set at 1,564.00 pts, or the high of 25 Jun. The higher resistance level is pegged at 1,575.50 pts, or the high of 22 Jun.

Source: RHB Securities Research - 28 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024