FCPO - Moving Away Above The 200-Day SMA Line

rhboskres

Publish date: Wed, 30 Jun 2021, 04:36 PM

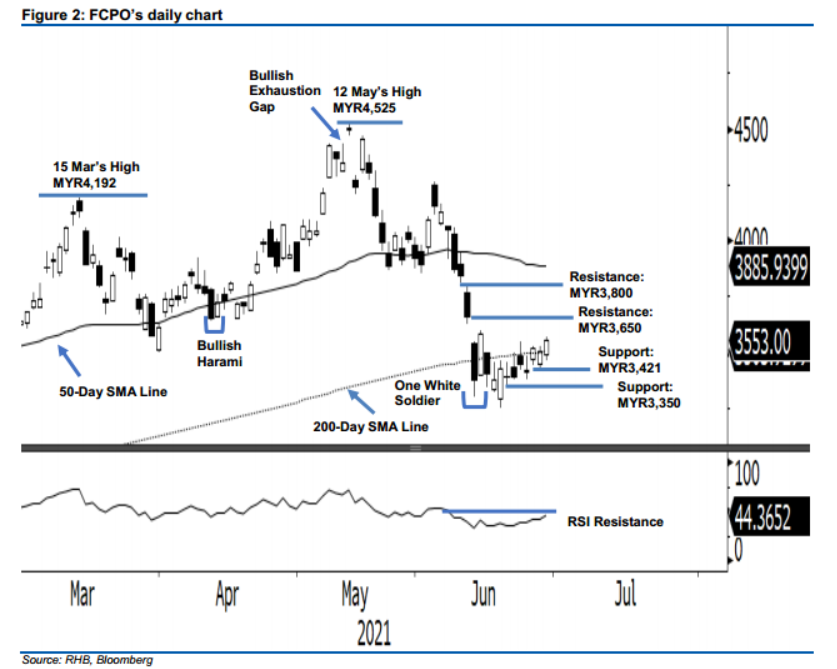

Maintain long positions. The FCPO broke away from the 200-day SMA line yesterday to close MYR47.00 stronger at MYR3,553. It opened lower at MYR3,489 to touch the intraday low at MYR3,460. The commodity then pared the losses by reversing upwards to test the MYR3,569 intraday high before closing at MYR3,553. The bullish candlestick indicates the bulls are now ready to move upwards beyond the 200-day SMA line, or MYR3,504. With sentiment tilted towards positive, the FCPO may continue to climb towards the nearest resistance at MYR3,650. However, though the RSI trend line is curving further upwards, it has yet to cross the 50% threshold – the positive strength may not stay long in the immediate sessions. Unless the stop-loss level is triggered, we remain with our positive trading bias.

We suggest traders stay in long positions. We initiated these at 25 Jun’s close of MYR3,520. To manage risks, the stop-loss threshold is revised higher to MYR3,375.

The support levels are revised to MYR3,421 – the low of 28 Jun – then MYR3,350, ie 21 Jun’s low. Towards the upside, the resistance levels are revised at MYR3,650 – the low of 16 Apr – and the MYR3,800 psychological level.

Source: RHB Securities Research - 30 Jun 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024