WTI Crude - Bouncing Off the Support Level; the Uptrend Remains

rhboskres

Publish date: Wed, 30 Jun 2021, 04:40 PM

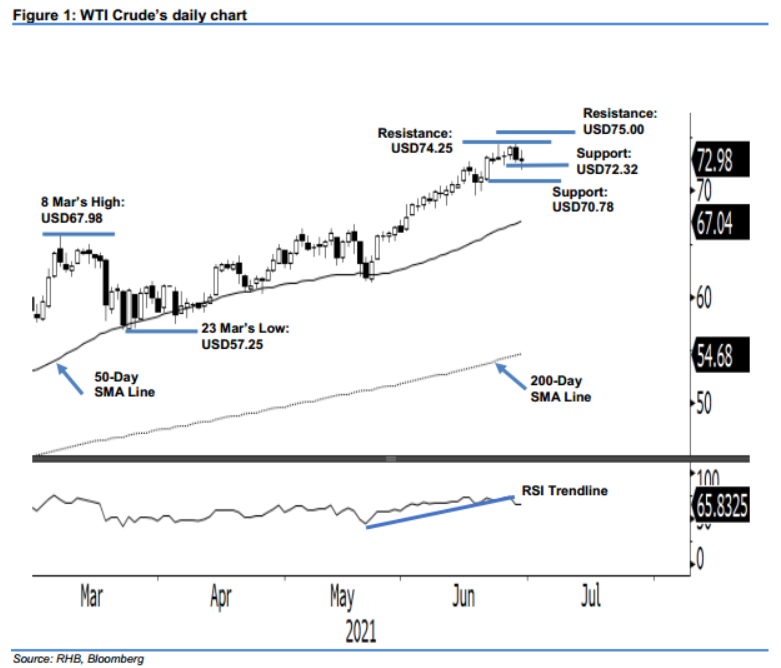

Maintain long positions. The WTI Crude saw its recent uptrend take a pause yesterday as it awaits cues from the OPEC+ meeting slated for 1 Jul. The commodity opened weaker yesterday at USD72.78. It initially dropped to the USD71.97 session low before bouncing to the USD73.81 session high – it settled at USD72.98. The black gold managed to see buying interest emerge near the session low, which reaffirmed our view that USD72.32 will act as a strong support level. As long as this level stays intact, the WTI Crude may resume its upward movement in the coming sessions. Premised on this, we stick to our positive trading bias.

We recommend traders stick with the long positions initiated at USD66.05, or the closing level of 24 May. To mitigate the risks, the trailing-stop threshold is set at USD72.00.

The immediate support is placed at USD72.32, or the low of 24 Jun, followed by USD70.78 – ie the low of 21 Jun. Meanwhile, the immediate resistance is sighted at 23 Jun’s high – USD74.25 – and followed by the USD75.00 psychological level.

Source: RHB Securities Research - 30 Jun 2021