Hang Seng Index Futures - Shifting to a Bearish Momentum Again

rhboskres

Publish date: Thu, 01 Jul 2021, 05:42 PM

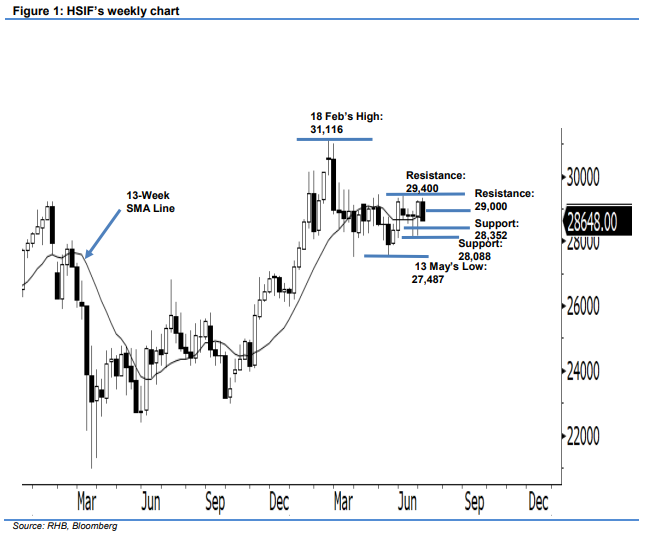

Stop loss triggered; initiate short positions. The HSIF saw the bulls taking a backseat recently – it closed at 28,630 pts yesterday after an uninspired session. On a weekly basis, it is clear that the index is moving sideways between the high of 29,400 pts and low of 28,088 pts. However, the HSIF has fallen below the 13-week SMA line, and the odds are favouring a downside risk. If the bearish momentum persists, the index may eventually correct lower towards 28,088 pts again. For the immediate term, the bulls may attempt to defend the 28,352-pt level. Conversely, we expect a strong resistance at 29,000 pts. Also take note that, on daily basis, the HSIF has breached our stop loss at 28,659 pts. Hence, we shift to a negative trading bias.

We close out the long positions initiated at 28,904 pts – the closing level of 25 Jun’s evening session – after the stop loss at 28,659 pts was triggered. Conversely, we initiate short positions at the closing level of 30 Jun’s day session, ie 28,630 pts. For risk management, the initial stop-loss mark is fixed at 29,100 pts.

The immediate support is revised to 28,352 pts – the low of 15 Jun – and followed by 28,088 pts, ie the low of 17 Jun. On the upside, the immediate resistance is pegged at the 29,000-pt psychological level and followed by 29,400 pts, or the high of 1 Jun.

Source: RHB Securities Research - 1 Jul 2021