WTI Crude - Testing the Resistance Again

rhboskres

Publish date: Thu, 01 Jul 2021, 05:44 PM

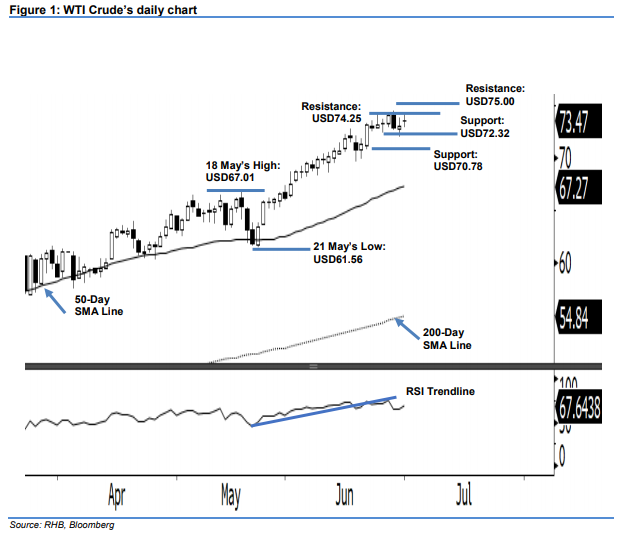

Maintain long positions. The WTI Crude saw volatility increase during the European session yesterday. At the end of Wednesday’s session, it recorded a minor gain of USD0.49 to settle at USD73.47. It initially started yesterday’s session stronger, gapping up to start at USD73.47. The WTI Crude then saw selling pressure dragging it to test the USD72.82 session low. Strong buying interest during the European session lifted it to touch the USD74.14 session high before closing at USD73.47. As the market is looking to the outcome of the OPEC+ meeting, the commodity will likely stay above the USD72.32 support level and consolidate. Breaching this may trigger a larger correction towards USD70.78. For now, we think the upside risk remains and stick to a positive trading bias.

Traders should retain the long positions initiated at USD66.05, or the closing level of 24 May. To mitigate downside risks, the trailing-stop threshold is fixed at USD72.00.

The immediate support is marked at USD72.32 – the low of 24 Jun – and followed by USD70.78, ie the low of 21 Jun. On the upside, the immediate resistance is pegged at 23 Jun’s high – USD74.25 – and followed by the USD75.00 psychological level.

Source: RHB Securities Research - 1 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024