FCPO - Bearish Reversal Signal Near Resistance Level

rhboskres

Publish date: Thu, 01 Jul 2021, 05:46 PM

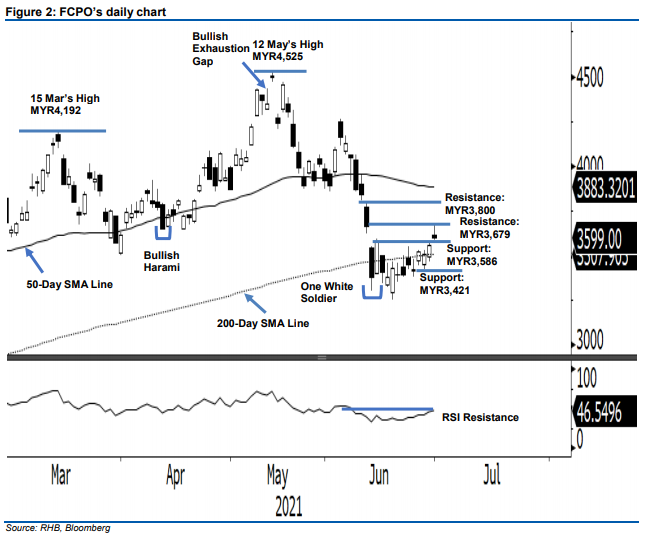

Maintain long positions. The FCPO’s recent rally was halted after it hit a resistance wall yesterday. Although it pared most of its intraday gains, the commodity still managed to advance MYR46.00 from the previous session. It initially opened the session with a gap-up at MYR3,610, testing the intraday high at MYR3,679. The bears were eager to book profits near the resistance level, dragging it to the MYR3,586 intraday low before closing at MYR3,599. Yesterday’s black body candlestick represents a ‘Shooting Star’ – the bulls were wavering near the resistance. If the commodity falls below the MYR3,586 support level, we may see selling pressure accelerate. The commodity may then seek support near the 200-day SMA line (MYR3,508), or the MYR3,421 level. Until the stop-loss level is triggered, we maintain our positive trading bias.

We suggest traders maintain their long positions. We initiated these at 25 Jun’s close of MYR3,520. To manage risks, the stop-loss threshold is revised higher to MYR3,586.

The support levels are revised to MYR3,586 – the low of 30 Jun – then MYR3,421, or 28 Jun’s low. Towards the upside, the resistance levels are pegged at MYR3,679 or the high of 30 Jun, followed by the MYR3,800 psychological level.

Source: RHB Securities Research - 1 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024