WTI Crude - Jumping Above the USD75.00 Level

rhboskres

Publish date: Fri, 02 Jul 2021, 05:06 PM

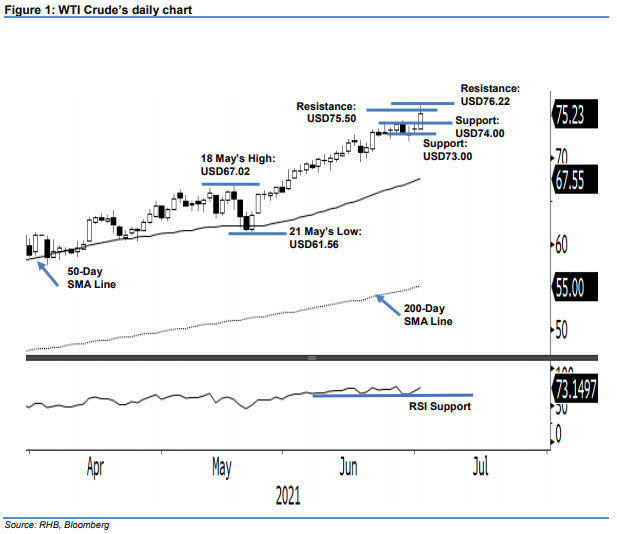

Maintain long positions. Strong demand lifted the WTI Crude to surpass the USD75.00 psychological level yesterday – a level last seen in 2018. The commodity started Thursday’s session flat at USD73.50. Strong buying interest started from the Asian trading hours, and saw the commodity progress higher, surging to the day’s high of USD76.22 before closing at USD75.23. The bulls dominated most of the session until profit-taking heightened near USD75.50 and USD76.00. It is likely that the commodity will move sideways and consolidate above the USD74.00 level before it retests the resistance. A breach below USD73.00 in the immediate term may see momentum decelerate. For now, the bulls are still in the driver’s seat, and hence, we keep our positive trading bias.

We recommend traders maintain the long positions initiated at USD66.05, or the closing level of 24 May. To mitigate downside risks, the trailing-stop threshold is raised to USD73.00.

The immediate support is revised to USD74.00 followed by USD73.00. On the other hand, the immediate resistance is pegged at USD75.50, followed by the USD76.22 high of 1 July.

Source: RHB Securities Research - 2 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024