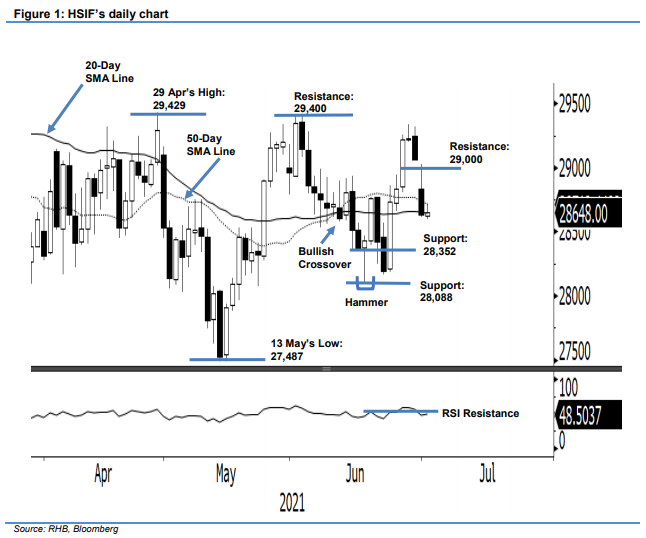

Hang Seng Index Futures - Struggling Below the 20-Day SMA Line

rhboskres

Publish date: Fri, 02 Jul 2021, 05:06 PM

Stop-loss triggered; Initiate short positions. Just before the Hong Kong market closed for holiday, the HSIF saw profit-taking activity on Wednesday, sending it 216 pts lower to settle the day session at 28,630 pts. It started Wednesday’s session stronger at 28,930 pts. After testing the day high of 29,026 pts, it turned towards the 28,611-pt day low and closed at 28,630 pts – breaching the stop-loss set at 28,659 pts. In the evening session, it recouped 18 pts to close at 28,648 pts. Based on the price action, the day session closed near its low, indicating that the bears dominated the session. Coupled with the index trading below the 20-day SMA line, it is likely that we will see negative momentum sustain and follow through in the coming sessions. We shift to a negative trading bias.

We closed out the long positions initiated at 28,904 pts, or the closing level of 25 Jun’s evening session, after the stop-loss at 28,659 pts was triggered. Conversely, we initiate short positions at the closing level of 30 Jun’s day session, or 28,630 pts. For risk management, the initial stop-loss is fixed at 29,100 pts.

The immediate support is revised to 28,352 pts – 15 Jun’s low – followed by 28,088 pts, or 17 Jun’s low. On the upside, the immediate resistance is pegged at the 29,000-pt psychological level, followed by 29,400 pts – 1 Jun’s high.

Source: RHB Securities Research - 2 Jul 2021