WTI Crude - Scaling Higher on Momentum

rhboskres

Publish date: Mon, 05 Jul 2021, 09:20 AM

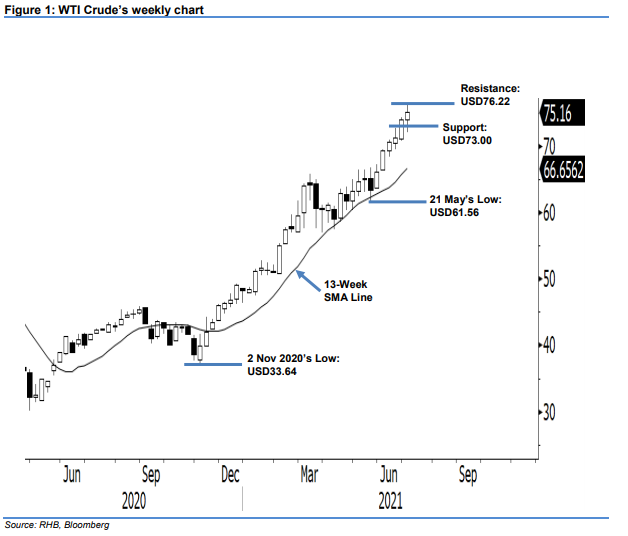

Maintain long positions. Since reaching its USD61.56 low, the WTI Crude has managed to record six consecutive weeks of gains. During the latest week, it rose USD1.11 to settle at USD75.16 – a level last seen in 2018. The latest weekly price action shows that the bulls are still in control of the uptrend. So far, there have not been any signs of exhaustion. Coupled with the black gold trading above the 13-week SMA line, it is likely that the uptrend will extend further in the coming weeks. As long as the WTI Crude continues to trade above the USD73.00 support level, we should not see a bearish reversal formation in the following week. Thus, riding on the momentum, the commodity may retest its recent high of USD76.22. As such, we keep our positive trading bias.

Traders should stick to the long positions initiated at USD66.05, or the closing level of 24 May. To protect against downside risks, the trailing-stop threshold is set at USD73.00.

In the daily chart, the immediate support is marked at USD74.00 followed by USD73.00. On the other hand, the immediate resistance is kept at USD75.50, followed by the USD76.22 high of 1 July.

Source: RHB Securities Research - 5 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024