E-Mini Dow - Continuing to March Higher

rhboskres

Publish date: Mon, 05 Jul 2021, 09:54 AM

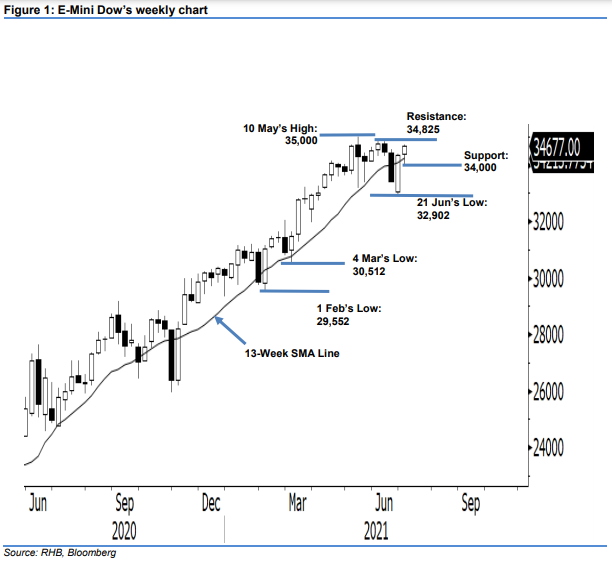

Maintain long positions. Based on the weekly chart, the E-Mini Dow ended the week on a positive note, gaining 344 pts over the week to settle at 34,677 pts. It started the week at 34,398 pts and fell to the intraweek low of 34,006 pts. It then rebounded to the 34,714-pt intraweek high and closed at 34,677 pts – forming a white body candlestick. Observe that the candlestick pattern also comes with a long lower shadow, forming a strong support near the 34,000-pt psychological level. In addition, the lower shadow tested and recoiled from the 13-week SMA line. This indicates that the bulls are back in the driver’s seat – possibly to grip the index higher and retest the immediate resistance of 34,825 pts, followed by the 35,000-pt all-time high. Hence, we keep our positive trading bias.

Traders should maintain the long positions initiated at 34,082 pts, or the closing level of 24 Jun. To manage trading risks, the stop-loss is placed at 33,900 pts – slightly below the psychological level.

In the daily chart, the immediate support is adjusted to 34,333 pts, which was the closing of 25 Jun, followed by the 34,000-pt psychological level. Conversely, the immediate resistance is at 7 Jun’s high of 34,825 pts, followed by 35,000 pts, which is the all-time high.

Source: RHB Securities Research - 5 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024