Hang Seng Index Futures - Testing the 28,000-Pt Psychological Level

rhboskres

Publish date: Tue, 06 Jul 2021, 09:20 AM

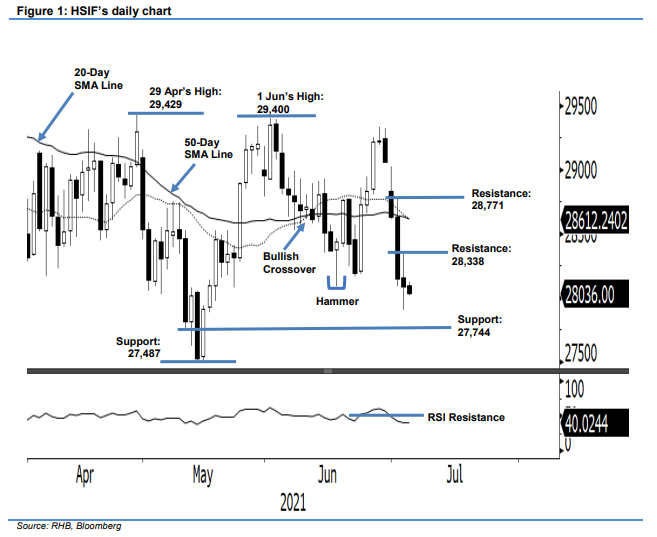

Maintain short positions. HSIF sentiment remained weak yesterday, with the index falling 63 pts to settle the day session at 28,086 pts – extending its losses since the start of July. On Monday, the index opened weaker at 28,190 pts and fell to the 27,901-pt day low. Soon after that, it staged a quick rebound towards the 28,252-pt day high. Momentum waned in the afternoon, with the index retracing to close at 28,086 pts. In the evening session, it lost another 50 pts and was last traded at 28,036 pts. From the price action, mild buying interest was witnessed near the 28,000-pt psychological level. However, we are mindful that support levels tend to be weak in a downtrend market. Unless the index climbs above the 50-day SMA line, or forms a fresh “higher high” pattern, downside risks will persist. As such, we maintain our negative trading bias.

Traders are recommended to keep the short positions initiated at 28,630 pts, or the closing level of 30 Jun’s day session. For risk management, the stop-loss is adjusted to 28,771 pts.

The immediate support is revised to 27,744 pts – 11 May’s low – followed by 27,487 pts, or the low of 13 May. The immediate resistance is revised to 28,338 pts, or the high of 5 July, followed by 28,771 pts, which was 2 Jul’s high.

Source: RHB Securities Research - 6 Jul 2021