WTI Crude - No Signs of Slowing Down

rhboskres

Publish date: Tue, 06 Jul 2021, 09:56 AM

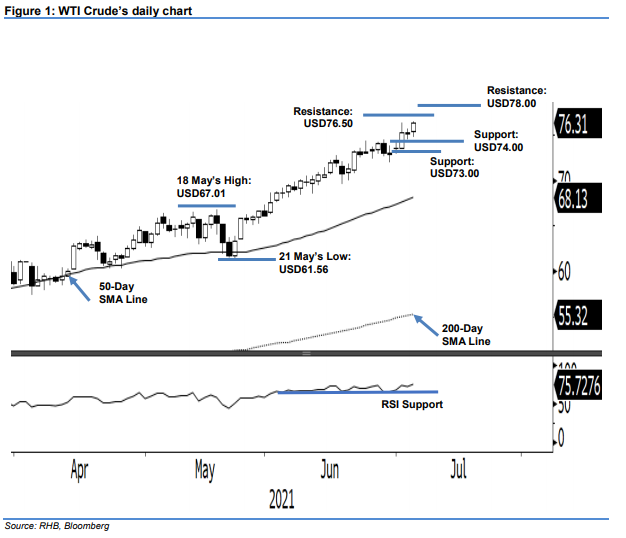

Maintain long positions. Amidst the failure of OPEC+ to reach a consensus on production output, the WTI Crude’s bulls seized the opportunity to grip the commodity higher to USD76.31 at the time of writing. After it settled at USD75.16 on Friday, the commodity resumed the session at USD75.35 and formed its intraday low at USD74.75. At one point, it surged to an intraday high of USD76.40. Based on the price action so far, the balance of strength is still tilted towards the bulls. With positive momentum gaining strength, the bulls may look to test the next resistance at USD76.50, followed by USD78.00. At this juncture, we maintain our positive trading bias.

We recommend traders stick with the long positions initiated at USD66.05, or the closing level of 24 May. To mitigate downside risks, the trailing-stop threshold is fixed at USD73.00.

The immediate support is marked at USD74.00, followed by USD73.00. On the other hand, the immediate resistance is pegged at USD76.50, followed by USD78.00.

Source: RHB Securities Research - 6 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024