WTI Crude - The Bulls Take a Breather

rhboskres

Publish date: Wed, 07 Jul 2021, 05:48 PM

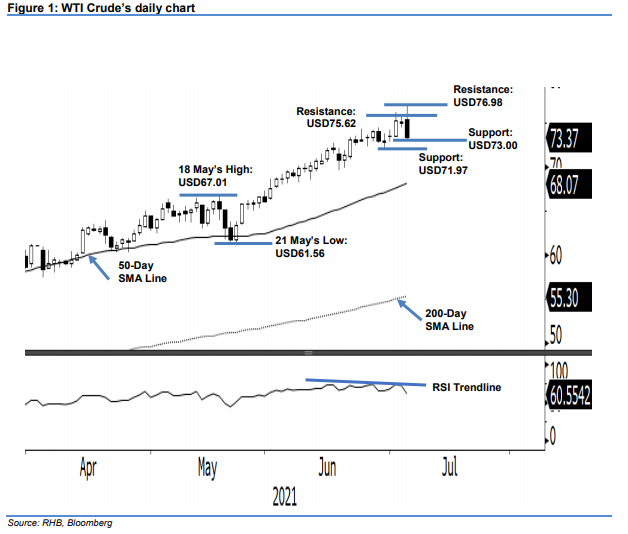

Maintain long positions. The WTI Crude’s bulls took a breather yesterday after the recent strong rally, declining USD1.79 to settle at USD73.37. On Tuesday, it rose to test the intraday high of USD76.98 during the Asian trading hours, but fell to the intraday low of USD72.94 during the US session – a day range (difference between the day’s high and low) of USD4.04. The wide day range – which indicates a volatile session – suggests that the interim top may have formed. Sentiment may turn bearish if negative momentum follows through in the coming sessions. On the other hand, if the commodity manages to consolidate sideways, the bulls may attempt to retest the upside resistance. For now, we are keeping our positive trading bias.

Traders should hold on to the long positions initiated at USD66.05, or the closing level of 24 May. To mitigate downside risks, the trailing-stop threshold is set at USD73.00.

The immediate support is marked at USD73.00, followed by USD71.97 or the low of 29 Jun. On the other hand, the immediate resistance is sighted at USD75.62, which was the 2 Jul’s high, followed by USD76.98 – 3 Jul’s high.

Source: RHB Securities Research - 7 Jul 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024