Hang Seng Index Futures - Falling Below the 28,000-Pt Psychological Level

rhboskres

Publish date: Wed, 07 Jul 2021, 05:49 PM

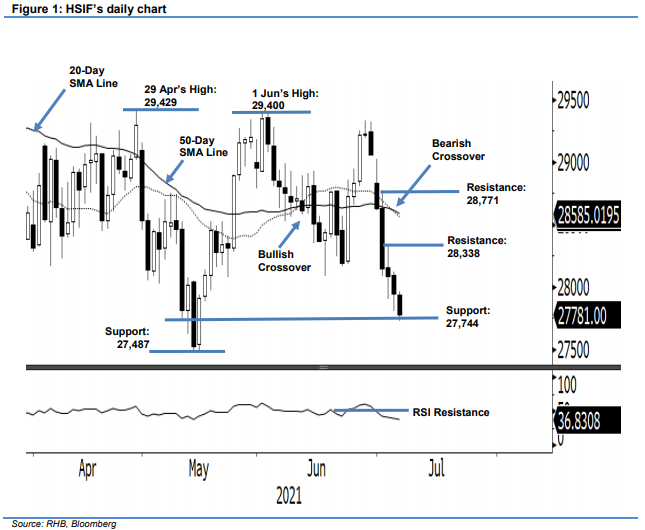

Maintain short positions. The HSIF sentiment took a dive yesterday, after the index failed to retain the 28,000-pt psychological level, falling 140 pts to settle the day session at 27,946 pts – its fourth consecutive session of losses. It started Tuesday’s session at 28,074 pts. Soon after touching the 28,109-pt day high, selling pressure heightened, and the index fell to the 27,806-pt day low before closing at 27,946 pts. In the evening session, it lost another 165 pts and was last traded at 27,781 pts. With selling pressure accelerating, it is likely that the index will test the 27,744-pt support level, followed by the next one at 27,487 pts. A breach of May’s low would result in a deeper correction. We observed that the 20-day SMA line crossed below the 50-day SMA line, indicating that the medium-term trend has become bearish. Premised on this, we keep our negative trading bias.

We recommend traders stick to the short positions initiated at 28,630 pts, or the closing level of 30 Jun’s day session. For risk management, the stop-loss is adjusted to 28,771 pts.

The immediate support is marked at 27,744 pts – 11 May’s low – followed by 27,487 pts, or the low of 13 May. The immediate resistance is seen at 28,338 pts, or the high of 5 Jul, followed by 28,771 pts, which was 2 Jul’s high.

Source: RHB Securities Research - 7 Jul 2021