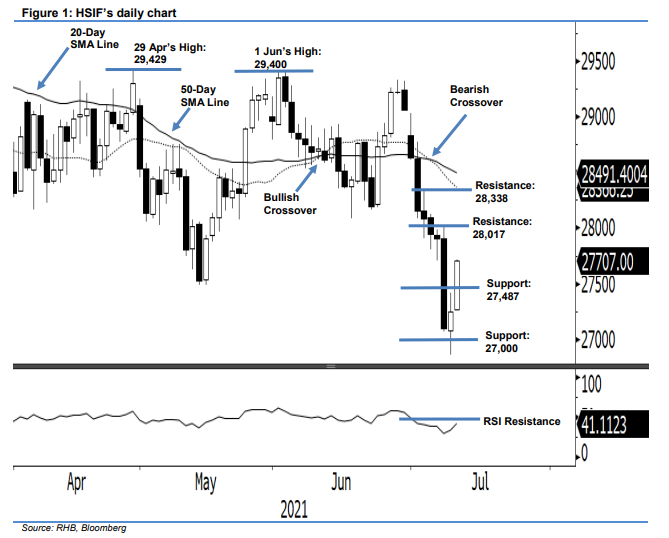

Hang Seng Index Futures - Defending the 27,000-Pt Support Level

rhboskres

Publish date: Mon, 12 Jul 2021, 09:40 AM

Maintain short positions. The HSIF saw a strong rebound last Friday, after the People's Bank of China decided to cut all Chinese banks’ reserve requirement ratio. It jumped 147 pts to settle the day session at 27,247 pts, after touching an intraday low of 26,859 pts. It formed a long lower shadow near the 27,000-pt psychological level. In the evening, the index rose further – adding another 460 pts – and was last traded at 27,707 pts. Given the strong momentum displayed on Friday, we will monitor to see if there is a follow through to breach the 28,017-pt resistance level. The latest technical rebound is in line with our previous note, and we still think that selling pressure could reemerge after the rebound. Until the index forms a fresh “higher high” pattern, we keep our negative trading bias.

We recommend traders stay in the short positions initiated at 28,630 pts, or the closing level of 30 Jun’s day session. To mitigate risks, the trailing-stop level is set at the 28,000-pt round figure.

The immediate support is placed at 27,487 pts, or 13 May’s low, and then the 27,000-pt psychological level. The resistance levels are eyed at 27,017 pts (8 Jul’s high), and 28,338 pts or 5 Jul’s high.

Source: RHB Securities Research - 12 Jul 2021