Hang Seng Index Futures - Testing the 28,000-Pt Psychological Level

rhboskres

Publish date: Wed, 14 Jul 2021, 05:49 PM

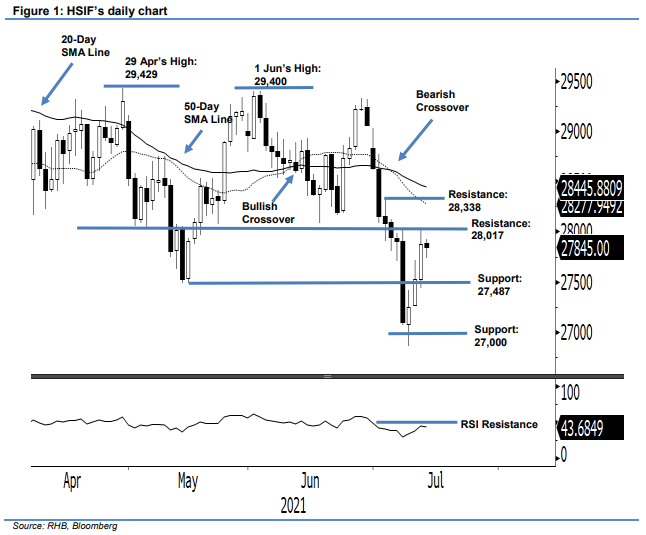

Maintain short positions. The HSIF rose higher for a third consecutive session, surging 349 pts to settle Tuesday’s day session at 27,880 pts – just shy of the 28,000-pt psychological level. It opened at 27,635 pts yesterday and established its intraday low at 27,592 pts. Strong bullish momentum lifted it to test the 28,017-pt day high before closing at 27,880 pts. During the evening session, the HSIF dipped slightly and last traded at 27,845 pts. From yesterday’s price action, the bulls failed to retain the 28,000-pt level – they may retest the psychological mark again in the near future. Crossing the threshold may see the index climb further higher to test the 20-day SMA line. However, it may need more consolidation before the technical breakout can happen. Meanwhile, we maintain the view that the current technical rebound may be capped at the psychological level. Hence, we retain our negative trading bias.

We think traders should hold on the short positions initiated at 28,630 pts, or the closing level of 30 Jun’s day session. For risk-management purposes, the trailing-stop mark is fixed at the 28,000-pt psychological level.

The immediate support remains at 27,487 pts, or 13 May’s low, and then the 27,000-pt whole number. Conversely, the resistance levels are pegged at 28,017 pts – 8 Jul’s high – and 28,338 pts, ie 5 Jul’s high.

Source: RHB Securities Research - 14 Jul 2021