WTI Crude: Attempting to Move Higher

rhboskres

Publish date: Wed, 15 Sep 2021, 06:32 PM

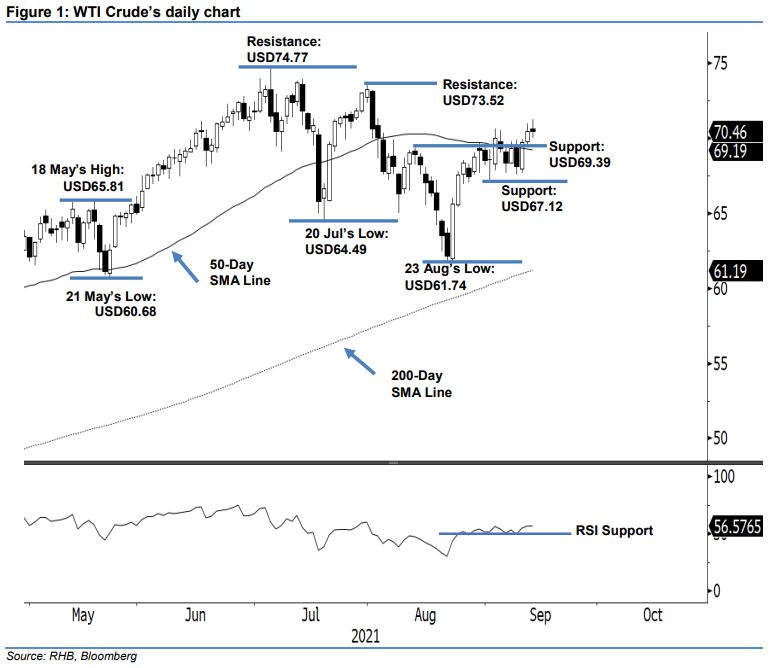

Maintain long positions. The WTI Crude saw intraday profit-taking yesterday and managed to close with a neutral tone at USD70.46 vs the previous close of USD70.45. The commodity started the session with a positive opening at USD70.64 and gradually moved northwards towards the USD71.22 day peak early during the US trading session. Strong selling pressure then emerged to drag the WTI Crude from the peak to the day’s bottom at USD69.98 before bouncing off at the close – slightly below the opening. The latest black body candlestick – with upper and lower shadows – closed at the previous close, signalling the bulls were taking a breather above the 50-day SMA line. We expect mild profit-taking – above the average line – to be seen in the immediate term before the WTI Crude is propelled higher in the medium term. As the RSI remains positive above the 50% level, we expect the medium-term bullish momentum to remain intact. With that, we stick with our bullish trading bias.

Traders should retain the long positions initiated at USD67.54, or the closing level of 24 Aug. To mitigate risks, the stop-loss level is pegged at USD67.12, ie 1 Sep’s low.

The support levels are fixed at USD69.39 – 12 Aug’s high – and USD67.12, or 1 Sep’s low. The immediate resistance level remains unchanged at USD73.52 – 30 Jul’s high – and followed by USD74.77, or 6 Jul’s high.

Source: RHB Securities Research - 15 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024