Hang Seng Index Futures : Testing the Immediate Support

rhboskres

Publish date: Mon, 27 Sep 2021, 08:57 AM

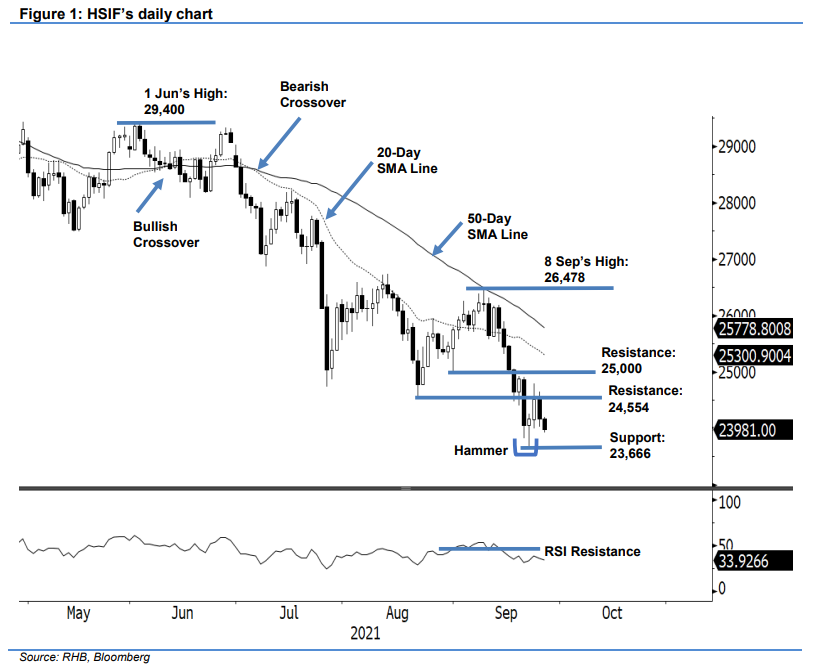

Maintain short positions. The HSIF’s bullish momentum was shortlived and failed to follow through last Friday. The index fell 351 pts to settle the day session at 24,168 pts. It initially opened at 24,350 pts and moved sideways for most of the early session – testing the 24,596-pt day high. It turned course in the late afternoon and dropped to touch the 24,034-pt day low before the close. During the evening session, the HSIF bucked its US peers’ trends to correct 187 pts lower – it last traded at 23,981 pts. The negative momentum on Friday erased the gains made during the previous session and headed lower to test the low of the Hammer at 23,666 pts. Breaching the immediate support will open the door for more downside corrections. On the other hand, bouncing off the immediate support may see a formation of “higher low” bullish patterns. At this stage, we stick to our bearish trading bias.

Traders should hold on to their short positions initiated at 25,646 pts, ie the close of 9 Sep’s day session. For trading risk management, the stop-loss threshold is set at 24,800 pts.

The first support is sighted at 23,666 pts – the low of 21 Sep – and followed by the 23,400-pt round figure. The immediate resistance remains at 24,554 pts – 20 Aug’s low – and a higher hurdle at the 25,000-pt psychological level.

Source: RHB Securities Research - 27 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024