FKLI: Attempting To Form a Higher Low

rhboskres

Publish date: Tue, 28 Sep 2021, 09:13 AM

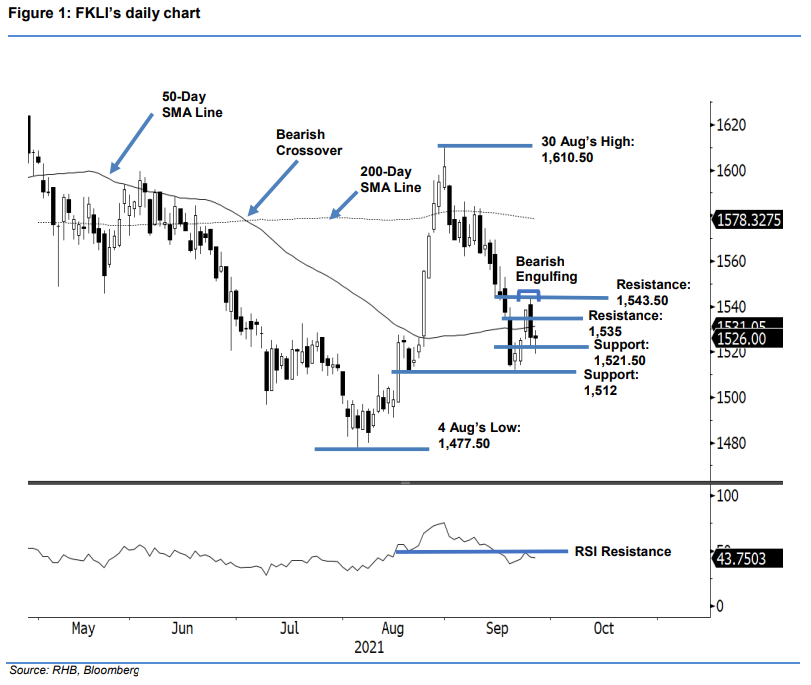

Maintain long positions. The FKLI saw volatility pick up on Monday’s session, dipping 0.5 pts to close marginally lower at 1,526 pts – still hovering below the 50-day SMA line. Initially, it had a shaky opening, starting at 1,527 pts and falling to the session’s low of 1,519 pts. During midday, buying interest grew stronger, sending the index higher to pare the intraday losses and close at 1,526 pts. The latest session printed a candlestick with long lower shadow, reaffirming that the 1,521.50-pt level is acting as a strong support. In the event, the index breaches the immediate support, sentiment will turn negative and lead to a downside correction. As of now, the FKLI is struggling to form a “higher low” bullish pattern, paving the way for a technical rebound to reclaim the 50-day SMA line. We are keeping to our positive trading bias until the stop-loss is breached.

We advise traders to hold on to their long positions, initiated at 1,538.50 pts or the closing level of 23 Sep. To mitigate trading risks, the stop-loss is fixed at 1,521 pts.

The immediate support is marked at 1,521.50 pts, or the low of 24 Sep, followed by 1,512 pts or 21 Sep’s low. The nearest resistance remains at 1,535 pt ie the opening of 20 Sep, followed by 1,543.50 pts (the high of 24 Sep).

Source: RHB Securities Research - 28 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024