WTI Crude: Attempting to Move Higher

rhboskres

Publish date: Wed, 29 Sep 2021, 08:36 AM

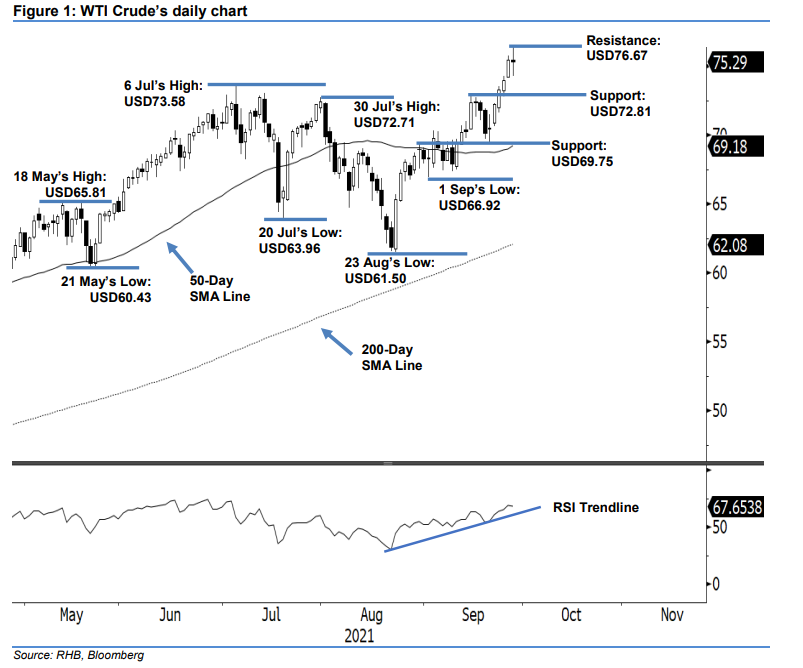

Keep long positions. The WTI Crude struggled to continue its rally yesterday after it pared down its intraday gains to close USD0.16 lower at USD75.29 – slightly below the opening. It opened at USD75.43 and gradually moved higher during the Asian trading session to hit the day’s top at USD76.67. It then shifted direction to downtrend towards end of the session – it touched the day’s bottom at USD74.24 prior to the close. The latest doji neutral candlestick at the peak suggests both bullish and bearish momentum are at equal strength. The following candlestick session will renew the signal – whether it is an uptrend continuation or mild profit-taking ahead. Also, the RSI strength is maintaining at around the 67% level yesterday. Consequently, we are more inclined towards a bullish continuation, as the RSI strength has not reached the overbought territory of 70%. As such, we maintain our bullish trading bias.

Traders should stay with the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage risks, the trailing-stop threshold mark is pegged at USD72.81, ie 24 Sep’s low.

The support levels are fixed at USD72.81, or 24 Sep’s low, and USD69.75 – 14 Sep’s low. The immediate resistance level is set at USD76.67, which was 28 Sep’s high. This is followed by the USD80.00 threshold.

Source: RHB Securities Research - 29 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024