WTI Crude: Pullback From the Top

rhboskres

Publish date: Thu, 30 Sep 2021, 09:33 PM

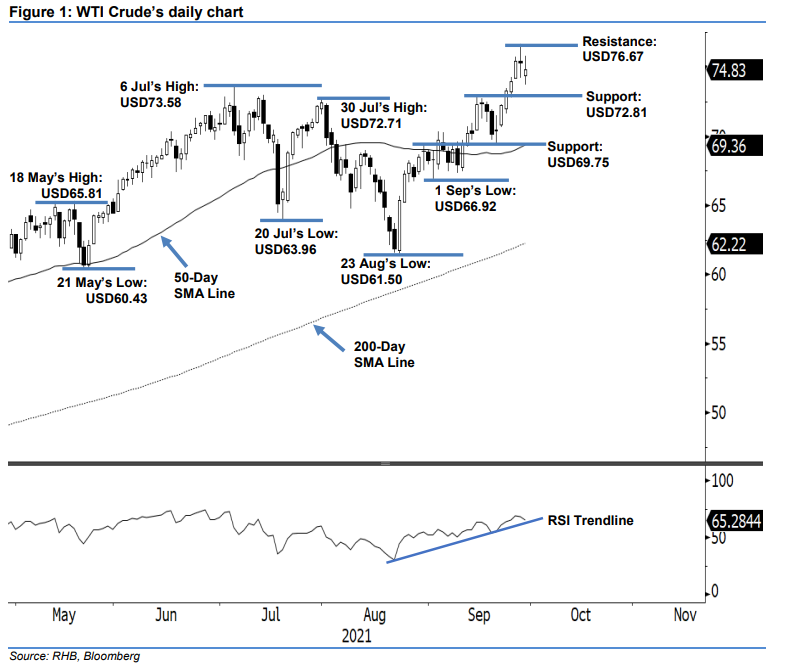

Keep long positions. The WTI Crude retraced from its recent high yesterday, settling USD0.46 lower at USD74.83 where it closed marginally higher than the opening. The commodity opened significantly lower at USD74.38 vs USD75.29 during the previous closed – and gradually moved lower until finding footing at USD73.74 during the mid-Asian trading session. Buying momentum then emerged to give the black gold wings to mark the intraday high at USD75.79 following the opening of the US trading session. Though shortlived, the WTI Crude fell strongly to substantially pare the gains towards the close. The latest candlestick with long upper shadow – which printed below the previous day’s close – signals that profit-taking activities have just started. Given that the RSI strength remains intact above the 60% level, we are of the view the pullback will be temporary above the immediate support before rebounding higher. As such, we stick to our bullish trading bias.

Traders should maintain the long positions initiated at USD67.54, ie the closing level of 24 Aug. To manage risks, the trailing-stop threshold is placed at USD72.81, or 24 Sep’s low – the immediate support.

The support levels are unchanged at USD72.81 – 24 Sep’s low – and USD69.75, ie 14 Sep’s low. The immediate resistance level is pegged at USD76.67, or 28 Sep’s high, before reaching the USD80.00 threshold.

Source: RHB Securities Research - 30 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024