FCPO: Advancing Higher Into Uncharted Territory

rhboskres

Publish date: Fri, 01 Oct 2021, 08:38 AM

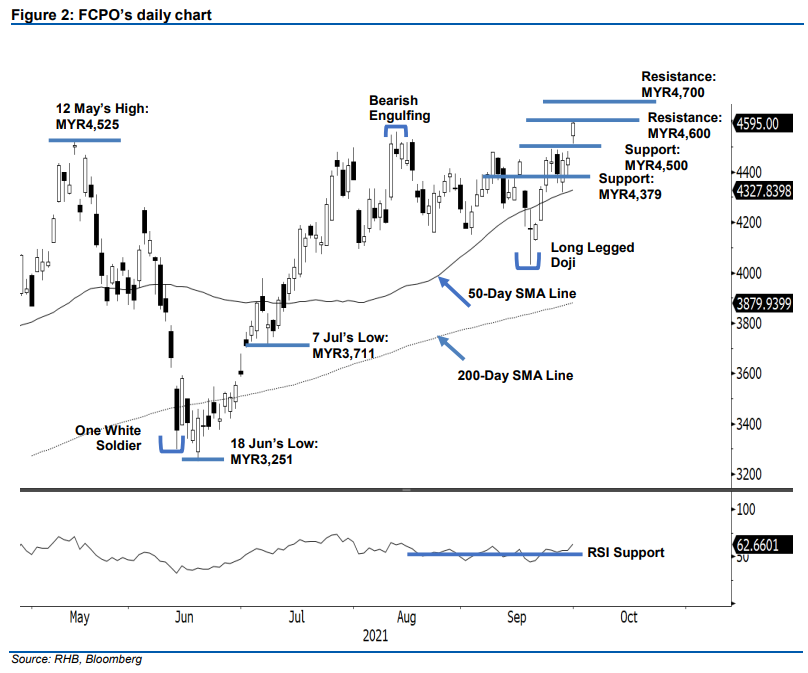

Maintain long positions. The FCPO experienced strong buying interest during Thursday’s session, soaring MYR140.00 to settle at MYR4,595 – an all-time-high. Yesterday, the commodity gapped up to start the session at MYR4,545. After mild profit taking activities, the commodity formed an intraday low at MYR4,512 then surged to reach the intraday high of MYR4,598 and closed at MYR4,595. As mentioned in the previous note, the commdotiy has maintained its bullish stance, with the positive momentum in full throttle now. While we do not discount the possibility of profit taking in the coming sessions, the RSI is heading higher, suggesting a follow through price action to test MYR4,600, followed by the MYR4,700 resistance level. In the event the momentum reverses, expect MYR4,379 to provide the strong support. As of now, we hold on to our bullish trading bias.

Traders should stick to long positions initiated at the closing level of 22 Sep, or MYR4,330. To mitigate trading risks, the trailing-stop is placed at MYR4,379, or the low of 29 Sep.

The immediate support is revised to the MYR4,500 round figure, followed by MYR4,379 ie the low of 29 Sep. Towards the upside, the immediate resistance is eyed at the uncharted terrioty of MYR4,600, followed by MYR4,700.

Source: RHB Securities Research - 1 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024