WTI Crude: Heading Towards the Immediate Resistance

rhboskres

Publish date: Mon, 04 Oct 2021, 08:40 AM

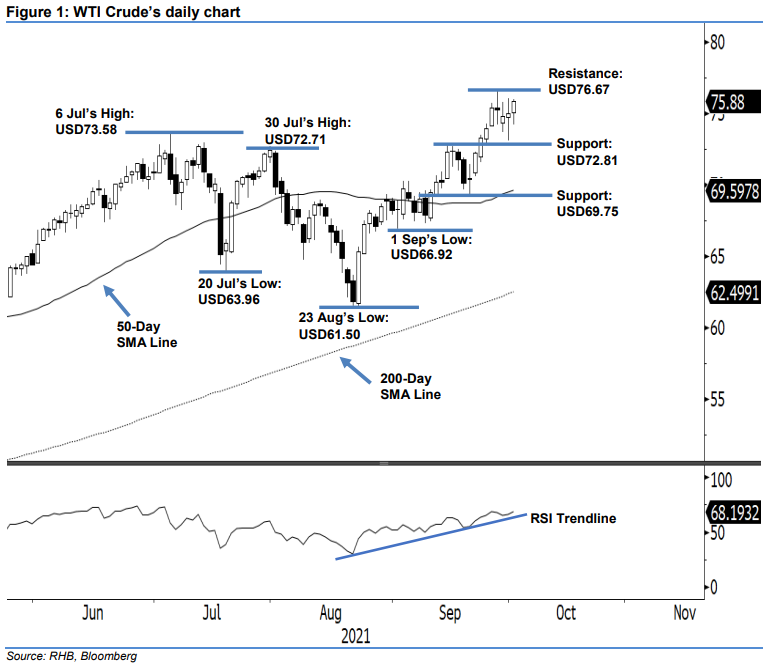

Keep long positions. The WTI Crude maintained its positive momentum, inching up USD0.85 yesterday to settle at USD75.88 – paring all its intraday losses to close higher. The commodity opened at USD75.12 and oscillated upwards between the USD74.23 intraday low and USD75.99 intraday high throughout the session, before closing higher. The white body candlestick with lower shadow shows that buying pressure is building up to propel the index towards the immediate resistance level of USD76.67. Supported by the strengthening of the RSI towards the 70% region, this strengthens our view that a positive rebound is imminent. As such, we stick to our bullish trading bias.

Traders should maintain the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage risks, the trailing-stop threshold is pegged at USD72.81, or 24 Sep’s low – the immediate support.

The support levels are placed at USD72.81 – 24 Sep’s low – and USD69.75, or 14 Sep’s low. The immediate resistance level is fixed at USD76.67 – 28 Sep’s high – ahead of the 52-week high at USD80.00.

Source: RHB Securities Research - 4 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024