WTI Crude: Soaring to a 7-Year High

rhboskres

Publish date: Tue, 05 Oct 2021, 08:38 AM

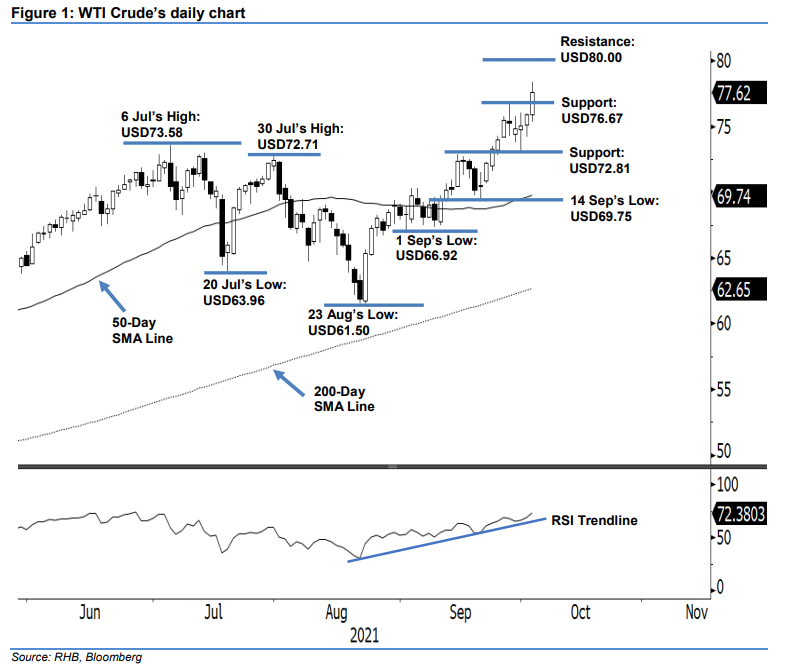

Keep long positions. The WTI Crude continued to mark multi-year highs yesterday, as it rose USD1.74 to settle at USD77.62 – breaching above the immediate resistance. The commodity opened at USD75.90 and oscillated sideways, touching the USD75.32 intraday low. Ahead of the start of the US trading session, it jumped to the USD78.38 intraday high, before retreating to the close. The long white body candlestick with upper shadow suggests that buying momentum has been renewed above the USD76.67 resistance-turned-support level, with a mild retracement expected in the coming sessions. Backed by the improving strength of the RSI into the 70% overbought region, this supports our view that the bulls may take a pause ahead of an intense rally. As such, we maintain our bullish trading bias.

Traders should stick to the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage risks, the trailing-stop threshold is marked at USD72.81, which was 24 Sep’s low.

The support levels are revised higher to USD76.67 – 28 Sep’s high – and USD72.81, which was 24 Sep’s low. The immediate resistance level is shifted to USD80.00, before it is anticipated to hit the USD90.00 threshold.

Source: RHB Securities Research - 5 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024