COMEX Gold: Positive Momentum Extended

rhboskres

Publish date: Tue, 05 Oct 2021, 08:39 AM

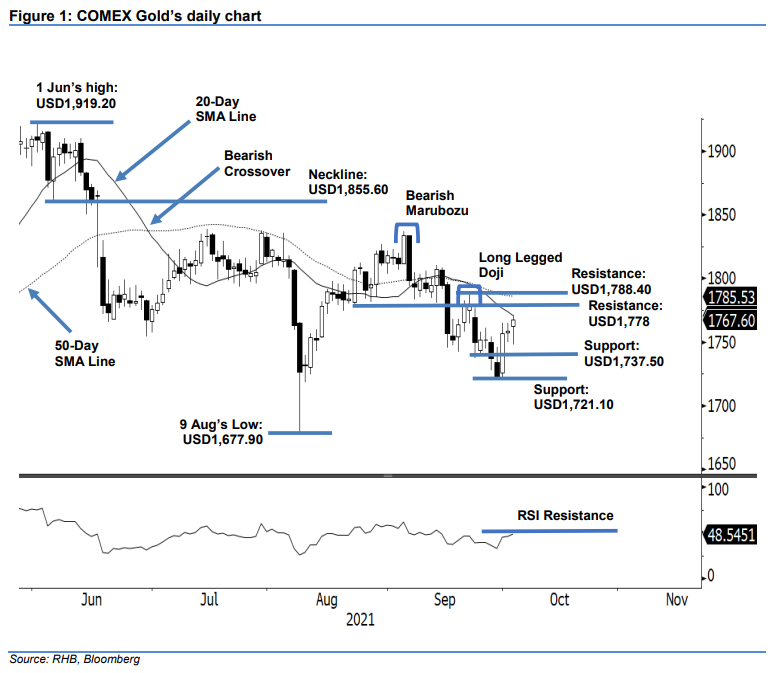

Stop-loss mark triggered; initiate long positions. The COMEX Gold saw the bullish momentum picking up pace yesterday, climbing USD9.20 to settle at USD1,767.60. The yellow metal started Monday’s session at USD1,762.60 before dipping to the USD1,747.70 day low. Strong buying interest emerged during the US trading session, lifting the commodity to touch the USD1,771.50 day high before closing stronger at USD1,767.60. With the latest positive price action, it managed to breach the previous resistance and formed a fresh “higher high” bullish pattern. If the RSI is able to surpass the 50% threshold in the coming sessions, this will enhance the bullish technical setup. Should the bears decide to take profits, the USD1,737.50 level will provide strong downside support. Since the stop-loss mark has been breached, we now shift to a positive trading bias.

We closed out the short positions initiated at USD1,756.70 – the closing level of 16 Sep – after triggering the stop-loss level at USD1,765. Conversely, we initiate long positions at the closing level of 4 Oct, ie USD1,767.60. To manage the trading risks, the initial stop-loss threshold is placed beneath the immediate support: USD1,737.50.

The immediate support is marked at USD1,737.50 – 23 Sep’s low – and followed by USD1,721.10, ie 29 Sep’s low. The nearest resistance is pegged at USD1,778 – 23 Aug’s low – and followed by USD1,788.40.

Source: RHB Securities Research - 5 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024